Draw Down & Maximum Draw Down - Draw Down Risk Management Chart

Day Trading Equity Management Strategies - Forex Trading Management Strategies

In any business, so as to make profit one must learn how to manage the risks. To earn profits in intraday Trading you as a trader need to learn about the different money management strategies discussed on this best learn in day trading tutorial website.

When it comes to day trading, the risks to be managed are potential losses. Using risk management rules won't only protect your trading account but also make you profitable in the long run.

What's Draw-Down? - Day Trading Equity Management and Equity Management Strategies

As traders the number 1 risk in day trading is also known as drawdown - this is the amount of money you've lost in your fx account on a single trade.

If you as a trader have $10,000 capital & you make a loss in a single trade of $500, then your draw down is $500 divided by $10,000 which is 5 % draw down.

Maximum Draw Down - What is Maximum Trading Draw Down?

This is the total sum of equity you have lost in your forex account before you begin making profitable trades. For example, if you have $10,000 in day trading capital & make five consecutive losing trade transactions with a total of $1,500 loss before making 10 winning trade transactions with a total of $4,000 profit. Then the draw-down is $1,500 divided by $10,000, which is 15 % maximum draw down.

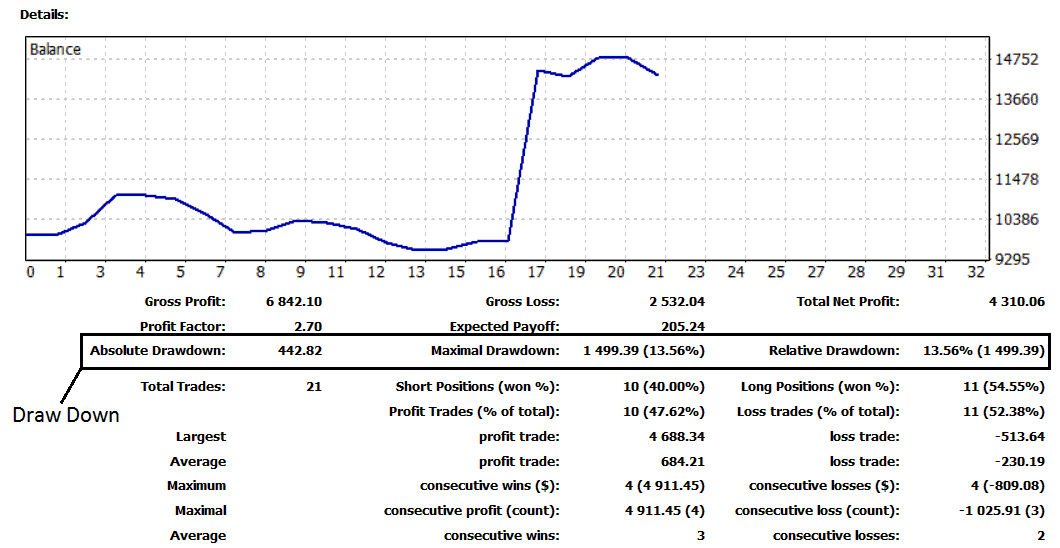

Forex Draw-Down is $442.82 (4.40%)

Maximum DrawDown is $1,499.39 (13.56 percent)

To learn how to generate above in intraday Trading reports using MetaTrader 4 platform: Generate Forex Trading Reports in MT4 Guide - DrawDown Equity Management Chart - Draw-Down Equity Management Calculator

Forex Equity Management - Day Equity Management Strategies

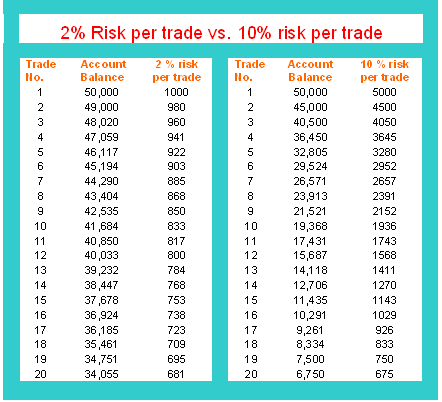

The in day trading example below shows the difference between risking a small percent of your capital compared to risking a higher percentage. Good Day Trading Equity Management Strategies guidelines requires you as the trader not to risk more than 2 % of your total account equity on any one single trade.

FX Percentage Risk Method

2 percent & 10 percent Equity Management Rule - Day Trading Risk Management Strategies

There is a large contrast between risking 2 % of your forex account equity compared to risking 10 % of your equity on one trade.

If you as a trader happened to go through a losing forex streak and lost only 20 trade transactions in a row, you would have gone from beginning equity balance of $50,000 to having only $6,750 left in your trading account if you as a trader risked 10% on every trade. You would have lost over 87.5 % of your account equity.

However, if you only risked 2 % you would have still had $34,055 in your trading account which is only a 32 percent loss of your total account equity. This is why it's best to use 2 % risk management strategy in day trading forex.

Difference between risking 2 % & 10 % on one trade is that if you risked 2 % you would still have $34,055 in your account after 20 losing trades.

However, if you as a trader risked 10% you would have only $32,805 in your trading account after only 5 losing trade transactions that's less than what you would have in your account if you risked only 2 % of your trading account & lost all 20 trades.

The point is you want to set-up your Day Trading Equity Management Strategies rules so that when you do have a loss making period, you'll still have enough in day trading equity to open a trade transaction next time.

If you lost 87.50 % of your in day trading capital you'd have to make 640% profit to go back to break even.

As compared to when if you lost 32 percent of your in day trading capital you'd have to make 47% profit to get back to the break-even. To compare it with the example 47 % is much easier to break even than 640% is.

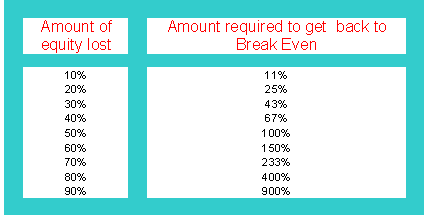

The chart below shows what percent you would have to make so that you as a trader can get back to break-even if you were to lose a certain percent of your in day trading capital.

Concept of Break Even - Draw-Down Equity Management Chart

Account Equity and Break Even - Money Management Strategies Draw Down Equity Management Chart

At 50% draw down, a trader would have to make 100% on their capital - a feat accomplished by less than 5% of all traders worldwide - just to breakeven on a account with a 50% loss.

At 80% draw down, one must quadruple their equity just to take it back to the original equity. This is what's known as to "break even" - which means - get back to your original account equity balance which you started with.

The more funds you lose, harder it is to make it back to your original account size.

This is why as a trader you should do everything you can to PROTECT your trading account equity. Do not accept to lose more than 2 % of your account equity on any one single trade.

Forex Money management is about only risking a small percentage of your capital in each trade so that you can survive your losing streaks and avoid a big draw-down on your account.

In day trading forex, traders use stop loss orders which are put in order to minimize losses. Controlling risks in day trading involves putting a stop loss after placing an new order.

Effective Risk Management

Effective in intraday Trading equity management requires mitigating all the risks in day trading forex and one should come up with a money management system & a funds management in day trading plan. To be in intraday Trading or in any other biz you must make decisions that-involve some risk. All in day trading factors should be interpreted to keep risk to a minimum & use above equity management tips on this article - Draw-Down Risk Management Chart.

Ask yourself? Some FX Trading Tips

1. Can the risks to your in intraday Trading activities be identified, what forms do they take? and are these clearly understood and planned for in your in intraday Trading plan? All the risks should be taken care of in your in day trading plan.

2. Do you grade the risks encountered by you when in day trading forex in a structured way? - Do you have a equity management strategy and a intraday Trading plan? have you read about this learning topic in day trading topic which is well covered explained here on this learn day trading site for beginners.

3. Do you know the maximum potential risk of each exposure for each trade which you place?

4. Are trading decisions made on basis of reliable & timely market information and based on in day trading strategy or not? Have you read about in day trading day systems on this learning website.

5. Are the risks large in relation to the trade turnover of your invested capital & what impact could they have on your profits margins and your account margin requirements?

6. Over what time period does the in intraday Trading risks of your in intraday Trading activities exist? - Do you hold in day trading trades long-term or short-term? what type of day trader are you?

7. Are the exposures in trading a one-off or are they recurring?

8. Do you know enough about methods in which day trading risks can be reduced or hedged and what it would cost in terms of profit if you did not include these measures to reduce potential loss, & what impact it would make to any upside of your profit?

9. Have your day trading equity management principles been addressed adequately, to ensure that you make and keep your in intraday profits.

Day Trading Equity Management and Day Trading Equity Management Strategies Methods - Draw-Down Day Trading Equity Management Chart - Draw Down Day Trading Equity Management Calculator