Choppiness Index MT4 Indicator and Choppiness Index Signals

Created by E.W. Dreiss

Choppiness Index was designed to be an easy but practical MT4 Indicator to help traders to determine if the currency prices are trending or consolidating.

This MetaTrader 4 Indicator is similar to ADX which is also designed to evaluate the strength or momentum of a market trend and determine if the market is trending or consolidating.

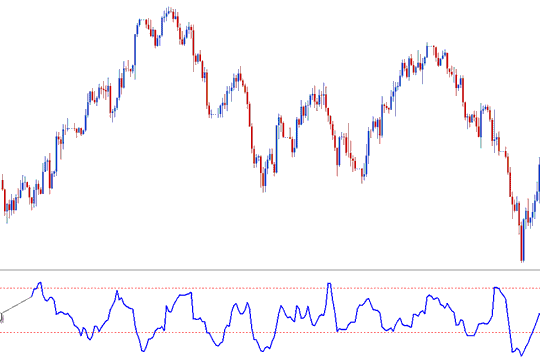

The Choppiness Index uses a scale of between 0 and 100. It also typically uses upper and lower bands at 61.8 & 38.2 respectively.

This MetaTrader 4 Indicator is plotted by first calculating the true range for each period and then adding the values of n-periods.

Second, it calculates the highest value and lowest value over n-periods and calculates their difference.

Third, it divides the sum of the true ranges & calculates the base-10 logarithm of this value.

Finally, it divides this value by base-10 logarithm of n price periods & multiplies the results by 100.

MetaTrader 4 Indicator & How to Generate Signals

Choppiness Index is a directionless MT4 Indicator meaning it does not determine in which direction the market is moving.

Its basic principle is that the more heavily the market is trending over the last number of n price periods the closer to zero the Choppiness Index indicator will be and the more heavier the market is consolidating and heading sideways in a range or chopping manner, over the last n-periods the closer to 100 the Choppiness Index will be.

MT4 Indicator values of above 61.8 indicate that the market is ranging/ choppy (moving sideways and consolidating).

Higher values occur during/after a strong consolidation phase. Higher values could also be interpreted as a trade signal of a potential upcoming break-out after a significant consolidation has occurred.

Choppiness Index values of below 38.2 indicate that the market is trending.

Lower values occur during/after a strong trending phase. Lower values could also be interpreted as a signal of a potential upcoming consolidation and choppiness after a strong trend phase has occurred.

Get More Tutorials and Courses: