AUDJPY News Strategies - Example of AUDJPY News Trading

Economic news releases for AUDJPY often evoke strong moves in the AUDJPY currency pair, creating a lot of short-term AUDJPY trading opportunities for AUDJPY breakout traders.

However, not all economic reports for AUDJPY are tradable. Some of the economic news have a significant effect on the AUDJPY currency pair while others do not have any effect on AUDJPY currency pair. By looking at the economic calendar traders can find out the significance of the upcoming reports for AUDJPY, and find out whether the economic report is worth trading or not when analyzing AUDJPY currency pair.

The AUDJPY Forex news reports are marked in terms of significance. There are three levels of significance: RED, ORANGE, GREEN. The most significant news reports for AUDJPY are marked in red: the least significant for AUDJPY are marked in green, while those marked in orange are in between.

AUDJPY News Strategies:

Trading the AUDJPY breakout channel - AUDJPY News Trading Forex Strategies

Forex Traders simply set Buy & Sell limit orders on both sides of AUDJPY price channel, so when the AUDJPY news data comes out one of the AUDJPY orders will probably be hit. Although this method is very simple, it also carries risks of potentially hitting the two AUDJPY orders: Buy & Sell AUDJPY trade orders as the market is volatile because of the economic reports. In such a double-hit situation traders will face losses on one or sometimes even both AUDJPY trades.

By analyzing the AUDJPY news report - AUDJPY NEWS Trading Forex Strategies

Forex Traders can predict most probable outcome of the AUDJPY news by looking at the AUDJPY economic calendar fields labeled as Forecast and Previous. These news figures are then compared with the economic data released to give an idea about the current economic situation so as to analyze how to trade the AUDJPY currency pair.

Forex traders trading AUDJPY watch the news report and pay attention to the actual numbers released. If the AUDJPY numbers come as a surprise meaning the reports are not close to what was expected or forecasted, then fundamental analysts opening AUDJPY positions will do so according to the economic reports - If the AUDJPY news report is better than expected then fundamental traders open buy positions. If the reports aren't favorable traders open Short positions.

The most important thing you have to know about AUDJPY fundamental analysis is the market expectation of an economic indicator. Economic analysts provide a prediction of a probable number of the economic indicator to be announced. This has an impact to the AUDJPY market and traders are positioned accordingly to trade AUDJPY currency pair. When the economic indicator is announced it affects the market only when the report is different from what the market expected. That happens because every available economic indicator available to the public information is already taken into account when trading AUDJPY.

Example of AUDJPY News Trading

The best AUDJPY news strategy, is one that is based on the economic news calendar used to time when the news releases are to happen so as to trade these AUDJPY data reports. A AUDJPY trader will keep a schedule of these economic new times and prepare how to trade the data before & after the data is released for the AUDJPY currency pair.

A AUDJPY trader can get the times of when the economic data for AUDJPY currency pair are to be released by observing an economic calendar. The economic news calendar contains the time-table of when news data for AUDJPY are bound to be released. The economic news calendar is compiled by Financial Analysts and Economist who study the fundamental reports & economies of the world. This News Calendar will show the timetable for all the news releases scheduled for the next 30 days for the AUDJPY currency pair.

By having this economic calendar a AUDJPY trader can schedule when to trade these AUDJPY economic data reports well in advance. To obtain a copy of this calendar one can search for "Forex Calendar" and you will find a couple of these economic calendars online hosted on various sites.

An Economic Calendar will normally have three readings:

- Previous Reading

- Forecast

- Actual News

Previous Reading - This piece of the data shows the previous value or reading of a previous news reports. Most fundamental reports are in the form of numeric numbers or percentages.

Forecast - Forecast shows the value for the news that economic experts predict for that particular report. This value is forecasted way before the date of the economic release. Economic and Financial Analysts will put across their forecast.

- If the forecast number is better than previous, AUDJPY traders will buy the currency associated with the good forecast

- If the forecast number is worse than previous, AUDJPY traders will sell the currency associated with the bad forecast

Actual News Release

This is what will determine if there'll be a large price movement or none at all.

If the actual data release is same to the forecast, then there will not be much movement, this is because AUDJPY traders anticipated this data and have already traded the news even before the actual data was released.

If the actual news release is not the same as the forecast, this will come as a surprise to the AUDJPY traders, if the forecast & actual data release is not the same then, the AUDJPY traders will have to adjust their trades accordingly and this will cause a price reversal in the opposite direction of the AUDJPY Currency.

If likewise the actual data reading was way better than expected, then price will continue towards its direction and gain further momentum towards that direction. Likewise, if the actual news report is worse than predicted price movement will also continue in the same direction as that of before the news release and this time gain more momentum & move further towards that direction.

Example:

When the new information is announced then it has impact on the market only if it's different than expected. If the information is as expected then it has no impact on the AUDJPY currency pair because the information is already available to the public and has already been taken into account.

In order to use the forex fundamental analysis, you should first be able to know market indicators. Economic calendar containing all the fundamental indicators is created by economists. Economists also use this Economic calendar to predict different news reports. These predictions are provided by market analysts. This can have great impacts on the market when trading the AUDJPY currency pair. AUDJPY Traders will watch out for news announcements that have a great impact on the financial markets.

When are economic news released? - AUDJPY News Strategy

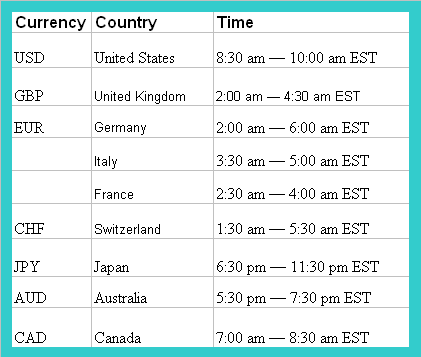

AUDJPY Economic Reports Announcement Times of the major economies and major currency pairs traded in the market.