How Can You Tell a Bearish Trend?

Definition of a Downward Trend

How Can You Tell a Bearish Trend? - How Can You Define a Bearish Trend?

A bearish trend or a down-wards trend is defined by prices closing with lower highs and lower lows. This is the definition of a bearish trend.

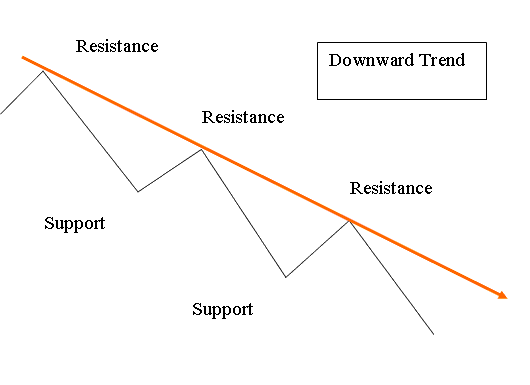

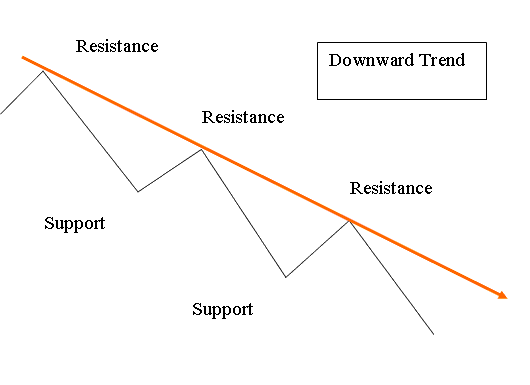

The example shown below defines the bearish trend setup

Simple Way to Identify Bearish Trend & Downward Trends

Trend is the market tendency of prices to move in a particular direction for a period of time

For a Downward trend the price will move in a general market direction downward.

This means prices will close lower than where they opened.

Trading Identify Down-ward Trend

A downward trend line is plotted above the downwards trend setup formed by consecutive lower highs, the downwards trend line must connect at-least 2 highs, with the recent most high being lower. For our down trend examples we shall use the MetaTrader 4 technical analysis software charts to illustrate example of the down-wards trend.

Since price moves downward in a zig zag manner traders normally draw a downwards trend line which shows the general downward trend direction. In analysis, this general market direction is known as the TREND by traders. In technical analysis definition we can define this down trend-line is plotted on a chart showing the resistance areas (bearish market direction).

Definition of a Down-ward Trend - Explain How Do I Identify Down Trend Market Direction

A down trend bearish market trend occurs when the price forms a series of lower highs and lower lows. Each price high is lower than the previous high - lower high, & each low is lower than the previous low - lower low hence showing bearish price trend movement.

Down trend trend-lines gain more validity every time price touches the down-wards trend line but doesn't penetrate the downwards trend-line. A down trend bearish market remains the general trend direction until this sequence of lower highs and lower lows is broken - trend line break.