What Happens in XAUUSD Trading after a Inverted Hammer Candlestick Sticks Pattern?

Inverted Hammer candle-sticks pattern is a bullish reversal candlestick pattern. It occurs at the bottom of a trend.

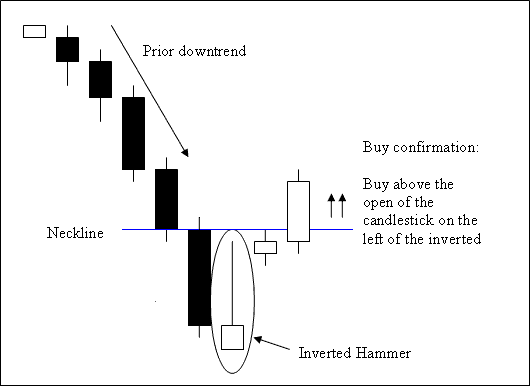

Inverted Hammer candles pattern occurs at bottom of a down trend & indicates the possibility of reversal of the downward trend.

What Happens in XAUUSD Trading after a Inverted Hammer Candlesticks Pattern?

Analysis of Inverted Hammer Candlestick Pattern

A bullish reversal buy signal is confirmed when a candle closes above the neck-line, this is the opening of candle that's on the left side of this inverted hammer candle trading pattern. The neckline point in this case forms the resistance zone.

Stop orders for the buy trades should be set few pips below the lowest price on the recent low once a trader opens a trade based on this candles pattern setup. An inverted hammer candles pattern is named so because it signifies that the market is hammering a bottom.