What Happens in XAUUSD after a Hammer Candles Setup?

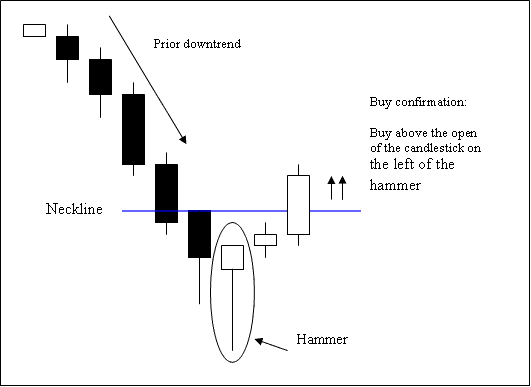

Hammer candlestick pattern is a potentially bullish candlestick pattern that forms during a downwards trend. It's named so because the market is hammering a bottom.

A hammer candlestick pattern has:

- A small body

- The body is at the top

- The lower shadow is 2 or 3 times the length of real body.

- Has no upper shadow or very small upper shadow if present.

- The color of the body isn't important

What Happens in XAUUSD after a Hammer Candles Pattern?

Technical Analysis of Hammer Candles Setup

The bullish reversal buy signal is confirmed when a candlestick closes above the opening price of the candle on the left side of the hammer candlestick pattern.

Stop Loss orders should be set few pips just below the low of the hammer candlestick once a trade is opened using this candle pattern formation.