Reversal Candle-stick Patterns - Inverted Hammer Candle Pattern

Inverted Hammer Bullish Candlesticks Patterns

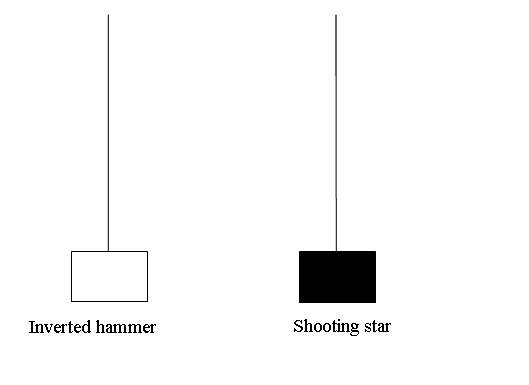

Inverted Hammer Candlesticks Pattern & Shooting Star Candlesticks Pattern candle-sticks look alike. These candlesticks have a long upper shadow and a short body at the bottom. Their fill colour doesn't matter. What matters is the point at where these candle-sticks appear whether at the top of a market trend (star) or bottom of market trend (hammer).

The difference is that inverted hammer candle-sticks pattern is a bullish reversal candle pattern while shooting star candles pattern is a bearish reversal candlestick pattern.

Upward Trend Reversal - Shooting Star Candles Pattern

Downward Trend Reversal - Inverted Hammer Candles pattern

Inverted Hammer Candlesticks Pattern & Shooting Star Candle Pattern Chart Setup Patterns

Inverted Hammer Candlestick Pattern

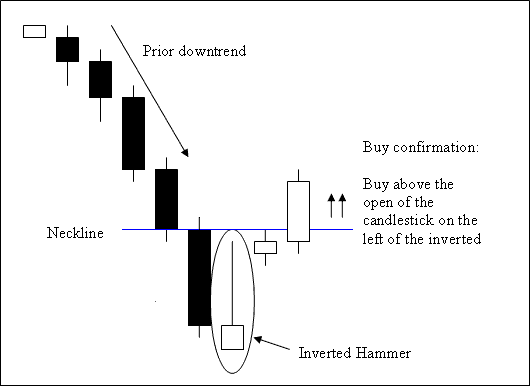

Inverted Hammer Candlestick Pattern is a bullish reversal candles pattern. It occurs at the bottom of a trend.

Inverted hammer candle-sticks pattern occurs at the bottom of a down trend & indicates the possibility of reversal of the downwards trend.

Inverted Hammer Candlestick Patterns - How to Trade Inverted Hammer Candle Sticks Patterns - How to Analyze Inverted Hammer Candlestick Pattern

Analysis of Inverted Hammer Candlestick Pattern

A buy is confirmed when a candlestick closes above the neck-line of the inverted hammer candlestick pattern, this is the opening price of the candle on the left side of this inverted hammer candlestick pattern. The neckline point in this case forms the resistance zone.

Stoploss orders for the buy gold trade transactions should be set few pips below the lowest price on the recent low of this inverted hammer candlesticks pattern.

An inverted hammer is named so because it shows that the market is hammering out a bottom.