How to Identify a Trend Reversal XAUUSD Signal

XAUUSD Trend Reversal Strategy

After price has moved in a particular direction for an extended period of time within a trend it gets-to a level where it stops moving within the market trend. When this occurs we say that the trend line has been broken and this is interpreted as a trend reversal signal.

Since the trend line is point of support or resistance & this point of support or resistance has been broken after a trend line break - we then expect the price to move towards the opposite direction and this is interpreted as a trend reversal signal.

When this happens traders will close the open orders that they had bought or sold. This is referred to as profit taking.

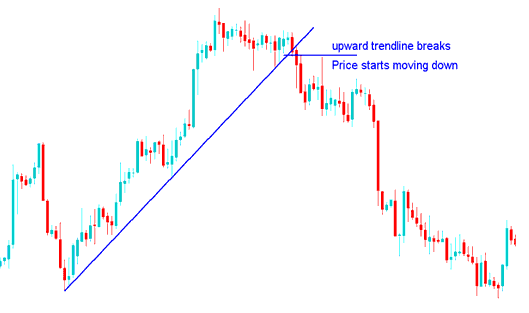

Up trend Reversal

When price breaks out below the upwards trend-line (support) market will then move downwards

Upwards Trend Line Break - How to Identify a Trend Reversal XAUUSD Signal

This trend reversal signal is considered to be complete with formation of a lower high of price. This also provides a trading opportunity to sell once the trend line is broken - gold reversal signal.

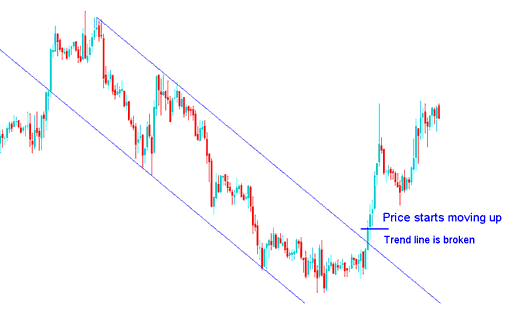

Down trend Reversal

When price breaks above downwards line (resistance) the price then will move up

Down-wards Trend Line Break -How to Identify a Trend Reversal XAUUSD Signal

This trend reversal signal is considered to be confirmed with creation of a higher low. This reversal setup also provides a trading opportunity to open a buy trade once the trend line is broken - trend line reversal trade signal.

NB: Sometimes when the price breaks its trend it may first of all consolidate before moving in the opposite market direction. Either way it is always good to take profit when market trend reverses.

To trade this reversal setup as a trader once you open a new trade in direction of market trend reversal the price should immediately move in that direction, in a price breakout manner. This means that the prices should immediately move in that direction without much of a resistance.

If on the other hand the prices do not immediately move in the direction of the price breakout then it is best to close out the trade because it means the trend is still holding.

Another tip is to wait for the trend line to be broken & for the market to close above or below it so as to confirm this trend reversal signal.

What happens is most traders open trades waiting for reversal even before the market trend is broken, only for the price to touch this trend line and for the current market trend direction to hold and the to continue with the current market trend.

Therefore, when trading this reversal setup it's best to wait til the price breakout has been confirmed by price closing above or below the trend line, depending on the direction of market.

- Upwards Market Trend Direction Reversal - this reversal xauusd signal is confirmed once the price closes below this upward trend line, this should be the right time to open a sell xauusd trade, so that to avoid a fake out.

- Down-wards Market Trend Direction Reversal - this reversal xauusd signal is confirmed once the price closes above the downward trend line, this should be the right time to open a buy trade, so that to avoid a whipsaw.