Candle patterns

The top candles patterns used to trade Gold - The top ten most often used candlesticks setups used to trade the online market.

Doji Candles Charts Patterns

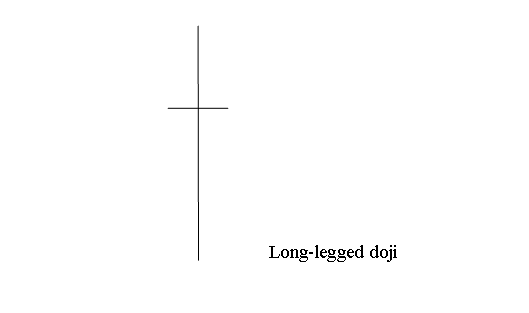

Doji is a candlestick stick pattern with the same opening and closing price. There are various types of doji candles pattern setup which form on charts.

following example show various patterns of the doji candle:

Long-legged doji candle pattern has long upper & lower shadows with opening and closing price at the middle. When Long legged doji appears on a chart it shows indecision between traders, the buyers and the sellers.

Below is an example snapshot of Long Legged Doji candle-sticks pattern setup

Doji Pattern - Doji Candles Charts Setup Patterns

Doji Pattern - Doji Candles Charts Setup Patterns

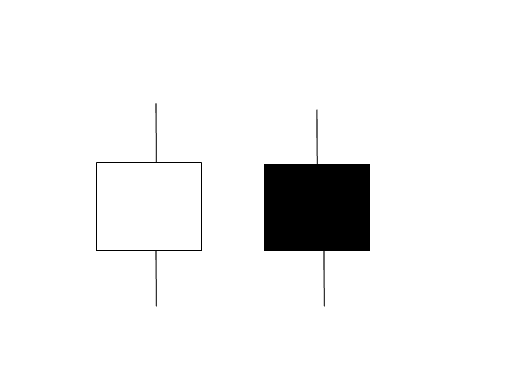

Marubozu Candlesticks Charts Setup Patterns

Marubozu candle stick pattern are long candlesticks that have no upper or lower shadows, Like displayed and illustrated below.

Marubozu Candle Sticks - Marubozu Candlesticks Charts Setup Patterns

Marubozu candle stick pattern are continuing candlestick setups which show price is going to continue in the same direction as that of marubozu candle. The marubozu candlesticks pattern setup can be white/blue or black/red depending on the direction of the trend.

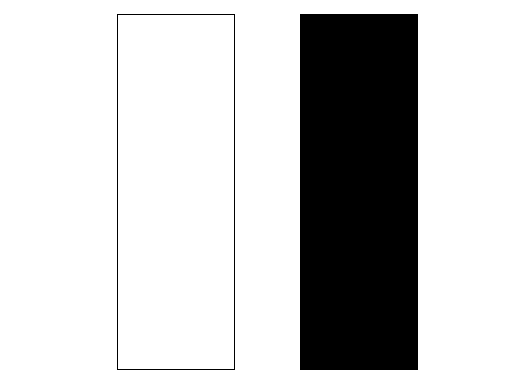

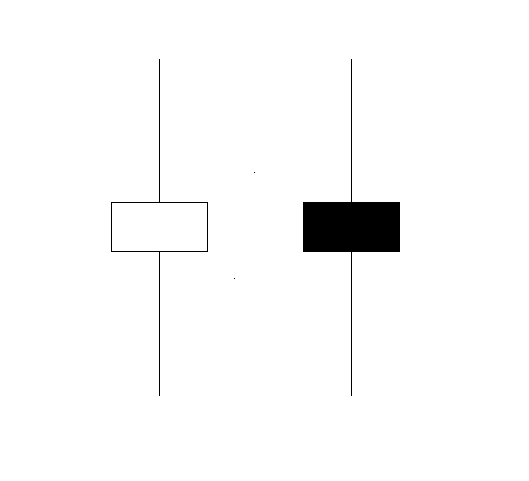

Spinning Top Candlesticks Candlesticks Charts Setup Patterns

Spinning tops candlestick pattern have a small body with long upper & lower shadows. The spinning top candle-sticks setups are referred to by this name because these candle-sticks arrangements are similar to spinning top on a matchstick.

The upper and lower shadows of the spinning top gold candlesticks pattern setup are longer than the body. Example illustrated and shown below shows the spinning top candlestick pattern. You can look for the pattern on your MT4 charts. Example illustrated and shown below shows a screen-shot to help traders when it comes to learning & understanding these candle stick pattern.

How Do I Analyze Candlestick Charts - Spinning Tops Candlesticks Charts Setup Patterns

Color of the spinning top candlestick xauusd candlesticks pattern setup isn't very important, this pattern show the indecision between the buyers & sellers in the market. When these setups appear at the top of a trend or at the bottom of trend it might signal that the market trend is coming to an end & it might soon reverse and begin going in the opposite direction. However, it is best to wait for confirmation signal that direction of a trend has reversed before taking the signal from the candle pattern formation.

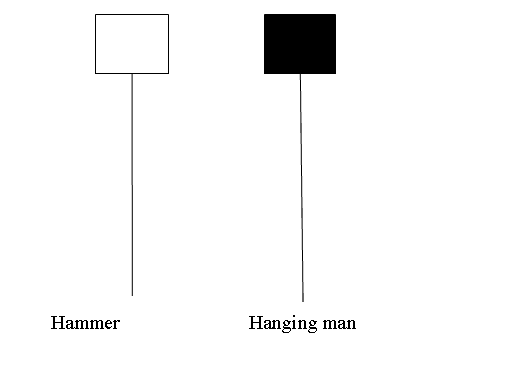

Hammer Candlestick Pattern & Hanging Man Candle Pattern Candlesticks Charts Setup Patterns

Hammer Candlestick Pattern and Hanging Man Candlestick Pattern candles look alike but hammer is bullish reversal xauusd candlestick pattern setup and hanging man is a bearish reversal xauusd candle pattern.

Hammer Candle Pattern & Hanging Man Candlestick Pattern - Candlesticks Charts Setup Patterns

Hammer Candlesticks Charts Setup Patterns

Hammer candle pattern setup is a potentially bullish gold candlestick pattern which occurs during a downward trend. It's named so because the market is hammering out a bottom.

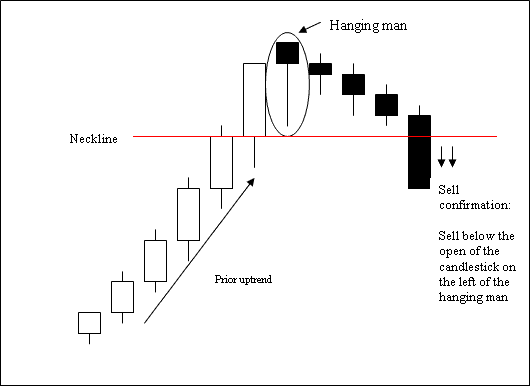

Hanging Man Candlesticks Charts Setup Patterns

This hanging man candle pattern is a potentially bearish xauusd reversal which forms during a upwards trend. It's named so because it looks like a man hanging on a noose up high.

Hanging Man Candlestick Pattern - Candlesticks Charts Setup Patterns

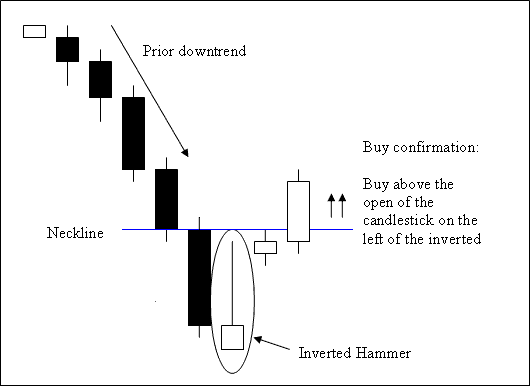

Inverted Hammer Candlesticks Charts Setup Patterns

This is a bullish reversal candle pattern. It forms at the bottom of a trend.

Inverted hammer candle pattern forms at the bottom of a down trend and indicates the possibility of a reversal of the downwards trend.

Inverted Hammer Candlestick Pattern - Candlesticks Charts Setup Patterns

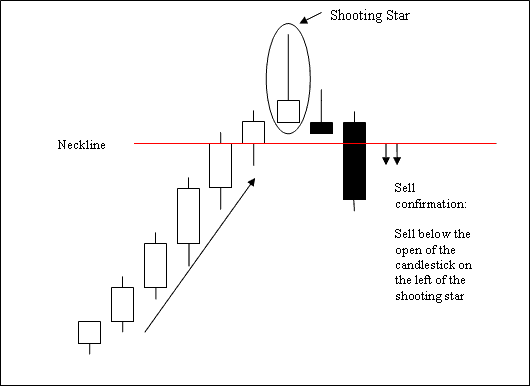

Shooting Star Candlesticks Charts Setup Patterns

Shooting Star is a bearish reversal candle pattern. It occurs at the top of a trend.

Shooting Star candlestick pattern setup form at the top of an up trend in the market where the open price is the same as the low & price then rallied up but was forced back down to close near the open.

Shooting Star Candlestick - Candlesticks Charts Setup Patterns

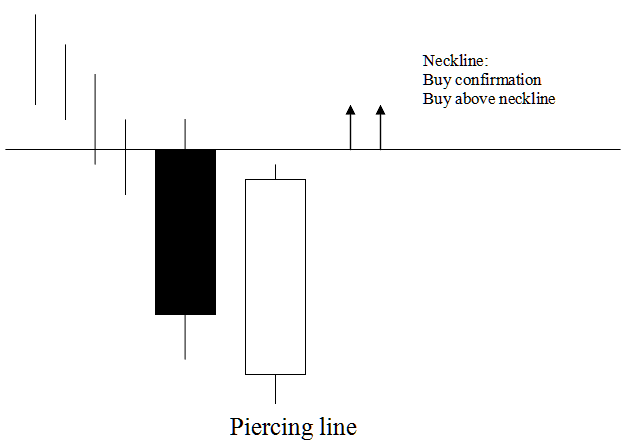

Piercing Line Candlesticks Charts Setup Patterns

Piercing line candle pattern is a long black body followed by a long white body candlestick.

White body pierces the midpoint of the prior black body.

This Piercing Line candle pattern setup is a bullish reversal candle pattern setup which occurs at the bottom of a market down ward trend. It shows that the market opens lower and closes above the midpoint of the black body.

This Piercing Line candle pattern setup highlights that the momentum of the down trend is reducing and the market trend is likely to reverse and move in an up-ward direction.

This Piercing Line candle pattern is displayed known as a piercing line signifying the market is piercing a bottom illustrating a market floor for price downward trend.

Piercing Line Candlestick Pattern - Candlesticks Charts Setup Patterns

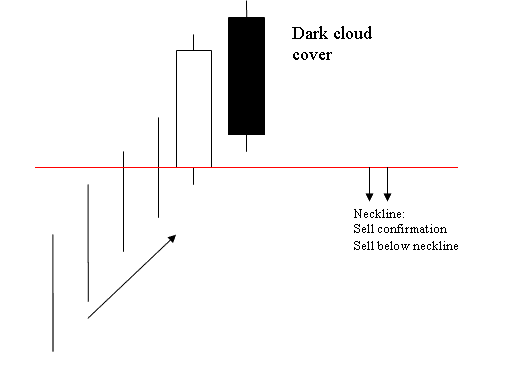

Dark Cloud Cover Candlesticks Charts Setup Patterns

Opposite of piercing candlestick stick candlestick.

This candle is a long white body followed by a long black body.

The black body pierces the mid point of previous white body.

This is a bearish reversal pattern setup which forms at the top of an up-ward trend.

Dark Cloud Cover candle stick pattern that the market opens higher and closes below the midpoint of the white body.

Dark Cloud Cover candlestick pattern setup highlights that the momentum of the up trend is reducing & the market trend is likely to reverse and move in a downward trade direction.

Dark Cloud Cover candle stick pattern is shown referred to as a cloud cover signifying the cloud as a ceiling for the price up-ward trend.

Dark Cloud Cover Candlestick Pattern - Candlesticks Charts Setup Patterns

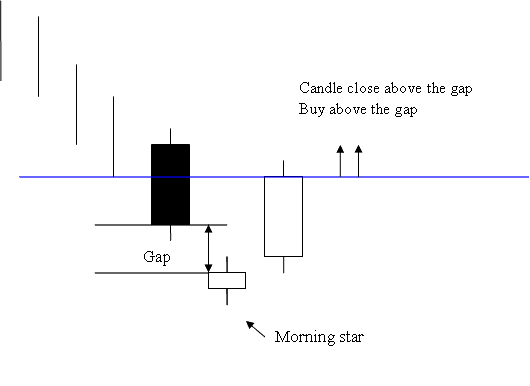

Morning Star Candlesticks Charts Setup Patterns

Morning Star Candlestick - Candlesticks Charts Setup Patterns

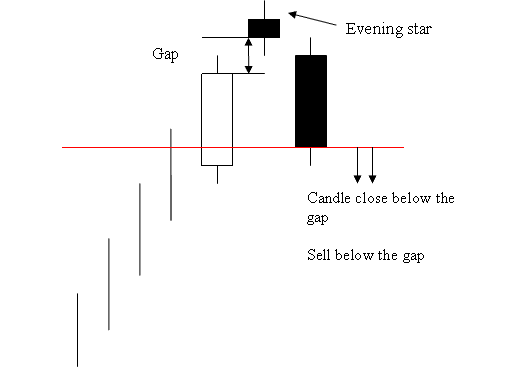

Evening Star Candlesticks Charts Setup Patterns

Opposite of morning star candles pattern setup

Evening Star Candlestick Pattern - Candlesticks Charts Setup Patterns

Candlesticks Charts Setup Patterns

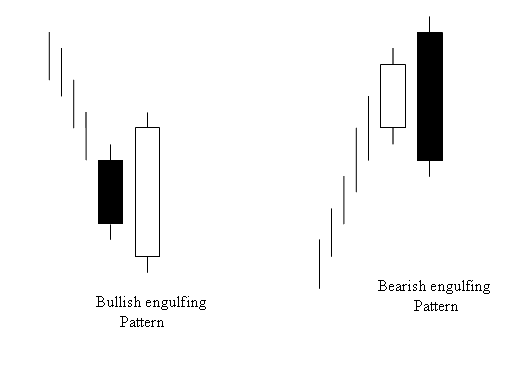

Engulfing is a reversal candle stick pattern which can be bearish or bullish depending upon whether it highlights up at the end of a market downward trend or at the end of a market upward trend.

Bullish and Bearish Engulfing Candle-sticks Setup Patterns - Candlesticks Charts Setup Patterns

Candle Patterns PDF - Candlestick Patterns Explained