How Do I Trade Price with Different Chart Timeframes?

Price Charting on Different Chart Time-Frames

Traders using analysis use charts to try & attempt to predict the movement of price on the charts.

Traders will sometimes use 2 or more chart time-frames so as to determine the long-term trend & short term trend.

How to Define A Price Trend

Using a system that has 3 indicators - MA Crossover System, RSI & MACD and using simple rules to define the market trend. The rules are:

Upward Trend

Both MAs Moving Up

RSI Indicator above 50 Mark

MACD Above Center-Line

Down-ward Trend

Both MAs Moving Down

RSI Indicator below 50 Mark

MACD Below Centerline

The traders using different chart timeframes will need to testout various chart time frames so as to determine the best chart timeframe for them to trade.

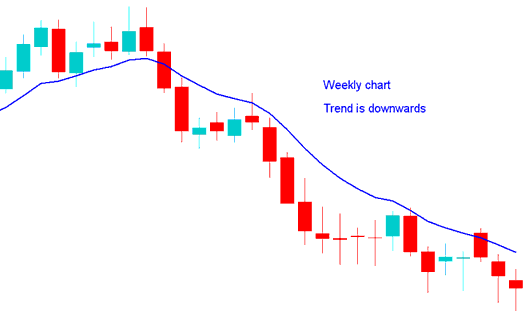

Multiple charts time frames analysis equals using 2 time-frames to trade xauusd - a shorter one used for trading & a longer one to check trend.

Since it is always good to follow the market trend, in Multiple Time-Frame Analysis, the longer timeframe gives us the direction of the long-term trend.

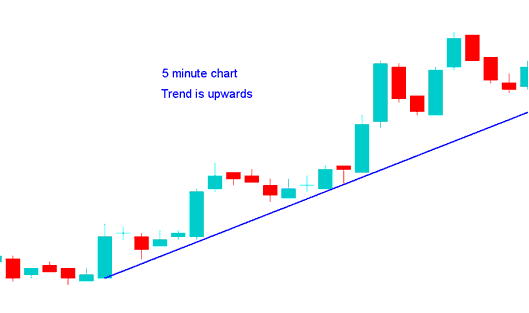

5 Min Chart Time-Frame

5 Min Chart Time-Frame - How Do You Trade Price with Different Chart Time-Frames?

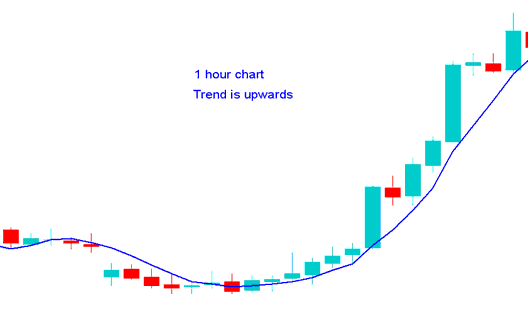

1 Hour Chart Time-Frame

1 Hour Chart Time-Frame - How Do You Trade Price with Different Chart Time-Frames?

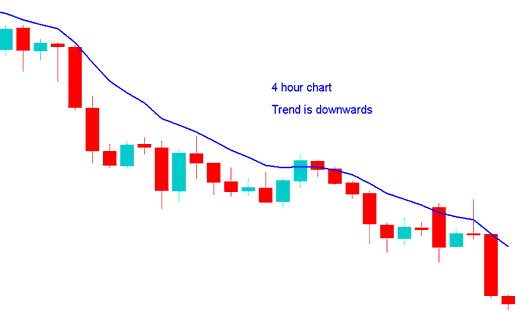

4 H Time-Frame

4 H Chart Time-Frame - How Do You Trade Price with Different Chart Time-Frames?

Week Chart Time-Frame

Week Chart Time-Frame - How Do You Trade Price with Different Chart Time-Frames?