How to Predict Chart Patterns Trend Reversal

How to Predict Chart Patterns Trend Reversal Signals

Trend reversal setups using Chart Patterns are used to predict trend reversals using Chart Patterns.

Chart Patterns trend reversal signals are used to trading signal when the current trend direction might reverse & begin moving in the opposite trend direction.

There are different Gold Chart Patterns trend reversal setups that are used by traders to try & determine when the price trend may reverse.

Among the different Gold Patterns - reversal setups which are used to identify trend reversals in xauusd are:

Chart Patterns Trend Reversals

Reversal xauusd patterns are patterns that form on the price charts that are used to identify reversal setups which signal potential trend reversals.

Reversal reversal chart patterns - reversal chart patterns are:

- Double Top Reversal Chart Pattern

- Double Bottom Reversal Pattern

- Head and Shoulders Reversal Pattern

- Reverse Head & Shoulders Reversal Pattern

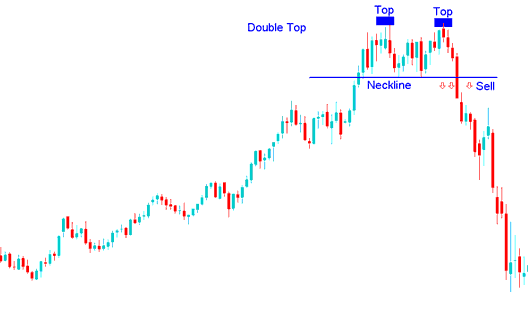

Double Top Reversal Chart Patterns

Double tops reversal pattern is a reversal chart pattern that's formed after an extended upwards trend. As its name implies, this setup is made up of 2 consecutive peaks which are roughly equal, with a moderate trough in between.

How to Analyze Double Tops Chart Patterns Trend Reversals

Double tops reversal pattern formation is considered complete once price makes the second peak and then penetrates the lowest point between the highs, called the neck-line. The sell signal from the formation forms when the price breaks out below the neckline.

In XAUUSD, double tops reversal chart pattern formation is used as an early warning signal that a bullish trend is about to reverse. However, it is only confirmed once the neck line is broken and the price moves below the neck-line. Neck line is just another name for the last support level formed on chart.

Summary:

- Double tops reversal pattern forms after an extended move upwards

- Double tops reversal chart pattern formation indicates that there will be a reversal in price

- We sell when price breaks out below the neckline point: see below for an explanation.

Interpret Double Tops Chart Patterns Trend Reversals?

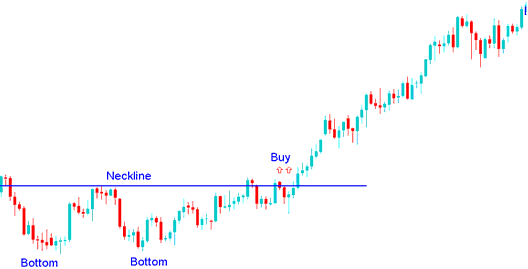

Double Bottom Reversal Patterns

Double bottoms reversal pattern is a reversal pattern that is formed after an extended downwards trend. It is made up of 2 consecutive troughs which are roughly equal, with a moderate peak between.

How to Analyze Double Bottoms Chart Patterns Trend Reversals

Double bottoms reversal pattern formation is considered complete once price makes the second low and then penetrates the highest point between the lows, called the neckline. The buy indication from the bottoming out signal occurs when the price breaks the neckline to the upside.

In XAUUSD, double bottoms reversal pattern formation is an early warning signal that the bearish trend is about to reverse. It's only considered complete/confirmed once the neckline is broken. In this formation the neck-line is the resistance area for the price. Once this resistance is breached the price will move upward.

Summary:

- Double bottom reversal chart pattern forms after an extended move downwards

- Double bottoms reversal chart pattern formation indicates that there will be a reversal in price

- We buy when price breaks out above the neck-line point: see below for an explanation.

Interpret Double Bottom Chart Patterns Trend Reversals? - Double Bottoms Chart Patterns Trend Reversals

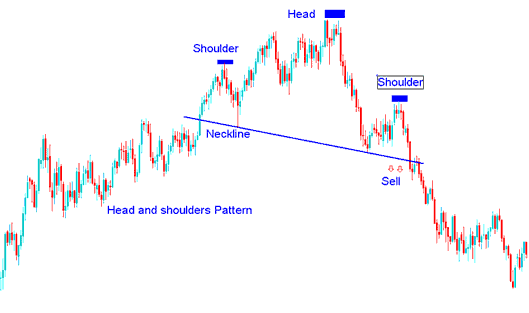

Head and Shoulders Reversal Patterns

Head & Shoulders reversal pattern is a reversal chart pattern which forms after an extended upwards trend. It's made up of 3 consecutive peaks, the left shoulder, head and the right shoulder with two moderate troughs between the shoulders.

How to Analyze Head and Shoulders Chart Patterns Trend Reversals

Head & Shoulders reversal chart pattern is considered complete once price penetrates and moves below the neck line, which is plotted by joining the two troughs between the shoulders.

To go short, traders set their sell stop orders just below neckline.

Summary:

- Head and Shoulders reversal chart pattern forms after an extended move upwards

- Head and Shoulders reversal chart pattern formation indicates that there will be a reversal in price

- Head and Shoulders reversal pattern formation resembles head with shoulders thus its name.

- To plot the neckline we use chart point 1 & point 2 as displayed below. We also extend this line in both directions.

- We sell when price breaks out below neckline point: see the chart below for explanation.

Interpret Head and Shoulders Chart Patterns Trend Reversals? - Head & Shoulders Chart Patterns Trend Reversals

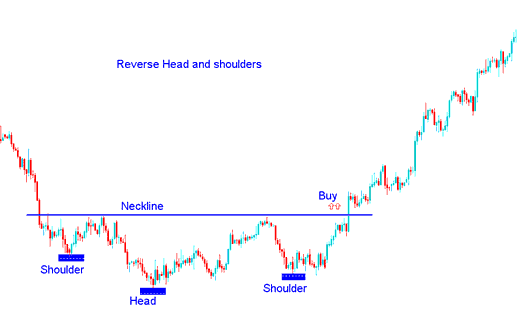

Reverse Head and Shoulders Reversal Patterns

Reverse Head & Shoulders reversal pattern is a reversal head and shoulders reversal chart pattern which forms after an extended XAUUSD Trading downwards trend. It resembles an upside down head shoulders.

How to Analyze Reverse Head and Shoulders Chart Patterns Trend Reversals

Reverse Head & Shoulders reversal chart pattern is considered complete once price penetrates above the neckline, which is plotted by joining the two peaks between the reverse shoulders.

To go long buyers/bulls set their buy stop trade orders just above the neck-line.

Summary:

- Reverse Head and Shoulders reversal chart pattern forms after an extended move downwards

- Reverse Head and Shoulders reversal chart pattern formation indicates that there will be a reversal in price

- Reverse Head and Shoulders reversal chart pattern formation resembles upside-down, thus the name Reverse.

- We buy when price breaks-out above neck-line point: see the chart below for explanation.

Interpret Reverse Head & Shoulders Chart Patterns Trend Reversals? - Inverse Head and Shoulders Patterns Trend Reversals

How to Predict Chart Patterns Trend Reversal - How to Predict Chart Patterns Trend Reversals - How to Predict Chart Patterns Trend Reversal Signals - How Do I Detect Chart Patterns Trend Reversal Setups