How Do I Analyze Reverse Head and Shoulders Chart Pattern?

How to Read Reverse Head and Shoulders Pattern

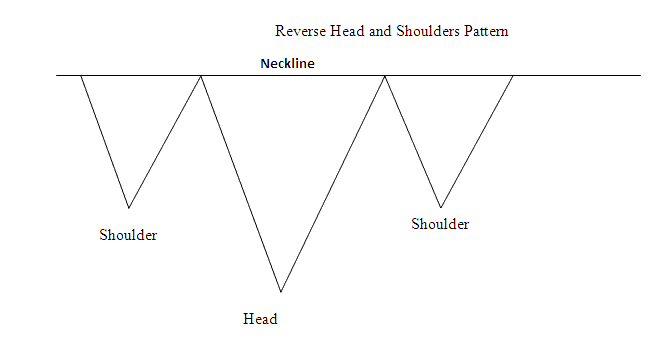

Reverse Head and Shoulders Chart Pattern is a reversal chart pattern that's formed after an extended downwards trend move. Reverse head and shoulders chart pattern resembles an upside down head and shoulders pattern.

Reverse Head and Shoulders Pattern is considered complete once the price penetrates & moves above the neck-line - the neck-line is drawn by joining the two price peaks that are between the reverse shoulders.

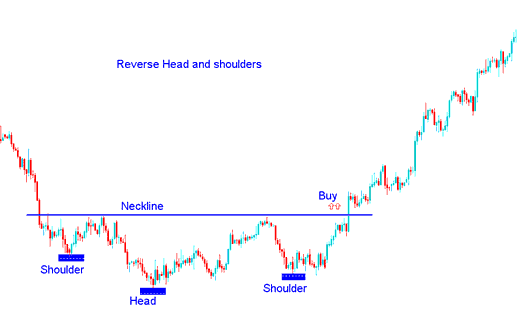

To open a buy trade - traders set their buy stop pending trade orders just above the neck-line.

Summary: How to Analyze Reverse Head & Shoulders Pattern?

- Reverse Head & Shoulders Chart pattern forms after an extended downwards trend move

- Reverse Head & Shoulders Chart Pattern signals that there'll be a reversal in the downward trend

- Reverse Head & Shoulders Pattern formation resembles an up-side down head and shoulders pattern - thus its name - Reverse Head & Shoulders Pattern.

- traders will buy when price breaks-out above neckline: as described on the reverse head and shoulders chart pattern example illustrated below.

How Do I Analyze Reverse Head & Shoulders Pattern

Reverse Head and Shoulders Chart Pattern on a Chart - Read Reverse Head and Shoulders Chart Pattern

How Do I Analyze Reverse Head & Shoulders Pattern

Interpret Reverse Head and Shoulders Chart Pattern