Read Continuation Chart Patterns

How to Analyze Continuation Chart Patterns

When continuation patterns are formed on the charts they confirm that the ruling trend direction is going to continue.

Continuation chart patterns are used by traders to determine the halfway point of the trend - this is because these continuation chart patterns form at the halfway point of a trend.

There are four different types of continuation trading patterns:

- Ascending triangle Continuation Chart Pattern

- Descending triangle Continuation Chart Pattern

- Bull flag Continuation Chart Pattern

- Bear flag Continuation Pattern

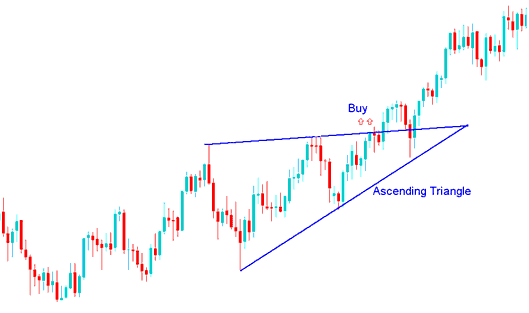

Ascending Triangle Continuation Pattern

The ascending triangle chart pattern is formed in an upward trend - it shows that the upwards trend direction is going to continue.

Ascending triangle chart pattern forms as a consolidation period within the upward trend and signals upside trend continuation.

Interpret Rising Triangle Chart Pattern

The gold price formed an ascending triangle pattern during its upward trend which led to upside continuation of the up-wards trend.

The buy signal is generated when price moves above the upper sloping line of the ascending triangle pattern.

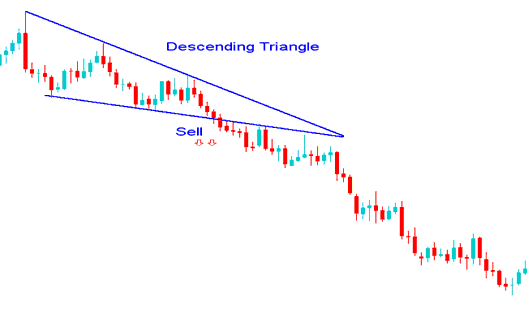

Descending Triangle Continuation Pattern

The descending triangle chart pattern is formed in a downwards trend and it shows that the downward trend movement is going to continue.

The descending triangle chart pattern forms as a consolidation period within the downward trend & signals downside continuation of the downward trend will follow.

Interpret Falling Triangle Chart Pattern

The gold price formed a descending triangle chart pattern during its downwards trend which led to a continuation of the downward trend.

The sell signal is generated when price breaks out the lower horizontal sloping line of the descending triangle pattern.

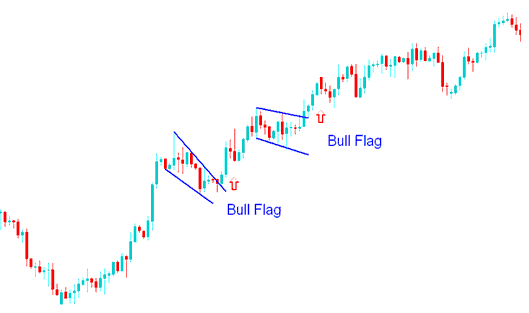

Bull Flag Continuation Pattern

Bull flag chart pattern forms what looks like a rectangle - formed by two parallel lines that act as support & resistance for the price until the price breaksout. In general, the bull flag chart pattern won't be perfectly flat but it'll be slanting.

Bull flag chart pattern occurs at halfway point of an upward trend & after a gold price break out a similar move equivalent to the height of the flagpole is expected.

Interpret Bull Flag Chart Pattern - How to Analyze Continuation Chart Patterns

The Bull flag pattern illustrated above was just a resting period as the market trend which then gathered momentum to break out & move higher.

The Bull flag pattern continuation signal was confirmed as upper line of the Bull flag pattern was broken to the upside.

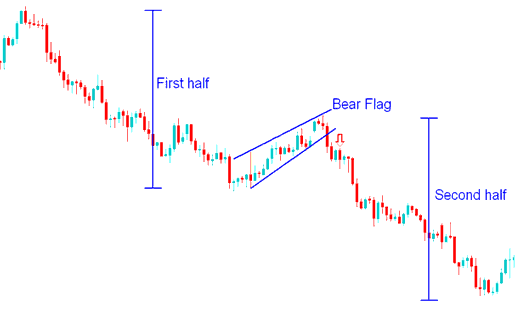

Bear Flag Continuation Pattern

Bear flag chart pattern flag is formed in a gold down-wards trend.

The Bear flag chart pattern is a continuation pattern where the price retraces slightly with a narrow price action that has a slight tilt upwards.

Interpret Bear Flag Chart Pattern - How to Analyze Continuation Chart Patterns

The Bear flag chart pattern illustrated above was just a resting period for the price prior to resuming the downwards trend.

The Bear flag chart pattern continuation signal was confirmed as the lower line of the Bear flag pattern was broken to the downside.

Read Continuation Chart Patterns