How Do You Analyze Trailing StopLoss Order?

How to Interpret a Trailing StopLoss Order

A trailing stoploss is a stop loss levels that keeps adjusting itself automatically by a set number of pips once the market moves in direction of the trader's open trade position by a number of pips.

For examples the trailing stop can be set at 30 pips and set to adjust itself to 30 pips automatically once the price moves up by 5 or 10 pips. This means that this trailing stoploss order will keep trailing the price as long as price keeps moving in the direction of the trader's open position.

This trailing stop loss will close the order once the market starts to retrace and it retraces to the level of the most recent set trailing stop loss level.

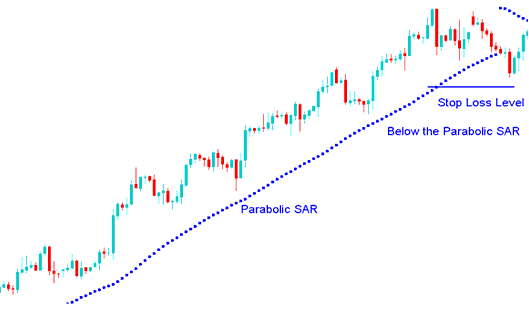

A good indicator used to set trailing stoploss levels is the Parabolic SAR technical indicator:

Parabolic SAR Indicator

Parabolic SAR is used by traders to set trailing price stoploss areas

The Parabolic SAR indicator provides good exit points which keep trailing the price of xauusd.

In an upward trend, you should close long trade positions when the price drops below the parabolic SAR

In a downwards trend, you should close short trades when the price rises above the parabolic SAR.

If you are trading long then the price is above parabolic SAR, the parabolic SAR indicator will move up every day, regardless of direction in which the price is moving. The amount of distance the parabolic SAR indicator moves up depends on the amount that prices moves. Once price moves below parabolic SAR as illustrated and shown on the example shown below, then traders should close their open buy gold trades at trailing stop level provided by the Parabolic SAR indicator.

Parabolic SAR Indicator - Indicator for Placing Trailing Stop-Loss Order Areas

Read a Trailing StopLoss Order