XAUUSD Pin Bar Price Action Patterns Indicator Combined with Fibonacci Retracement Levels Indicator

These pin bar price action set-up setups are often created near extremes in market swings, & they often happen at after false breakouts. This is why this pin bar price action pattern is used to place trades in the opposite direction of the tail of this price action setup.

A pin-bargold price action trade set up is a reversal price action signal on a chart which highlights an obvious change in the market sentiment during that particular period.

This pin bar candlestick has a long tail with the closing price near the open. The pin bar candlestick looks like a pin thus the name Pin Bar - occurs after an extended trend move upward or downward.

How Do I Trade Price Action Pattern with Fibonacci Retracement Levels Indicator

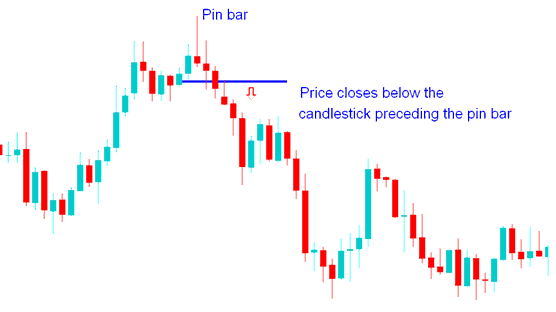

This price action reversal xauusd signal is confirmed after market closes below the candlestick that precedes this price action pattern.

Below the pin bar price action reversal setup pattern setup is confirmed after the market closes below the blue candle that preceded this price action pin-bar candle.

How Do I Trade Price Action Pattern with Fibo Retracement Zones Indicator

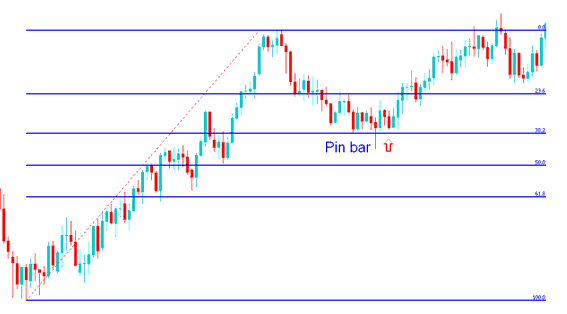

Combining Pin Bar Price Action Pattern with Fibonacci Retracement Areas

This pin bar price action setup signal can be combined with other line studies such as Fib retracement levels to generate buy or sell trade signals.

These pin bar price action set-up setups are often created near extremes in market swings, and they often happen at after false breakouts. This is why this pin bar price action pattern is used to place trades in the opposite direction of the tail of this price action setup.

Gold Fibonacci Retracement Areas

Pin bars price action trade set ups that form after price touches a Fibo retracement level can also be used as signals to enter the market.

XAUUSD Pin Bar Price Action Patterns Indicator Combined with Fibo Retracement Zones Indicator

These pin bar price action patterns are often created near extremes in market swings, and they often form after false breakouts of price action.

This is why this reversal price action pattern is used to place trades in the opposite direction of the tail of the pin bar candle.