Downwards Bitcoin Trading Trend

What is Trending in a Downward Bitcoin Trading Direction?

A Bitcoin Cryptocurrency Downtrend Market signifies a market environment where the prevailing price movement for Bitcoin is downward, meaning Bitcoin prices are generally settling at levels lower than their opening prices.

What is Trending in a Downwards Direction?

How to Interpret and Analyze Downward BTC/USD Trend

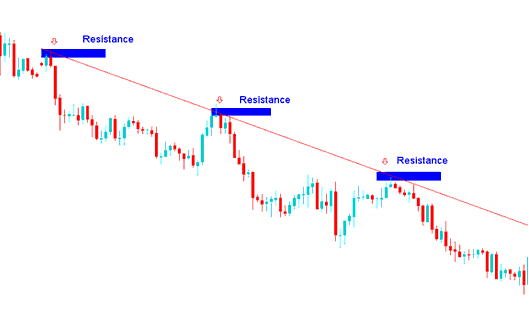

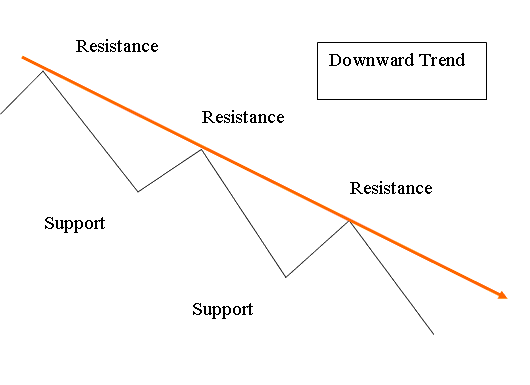

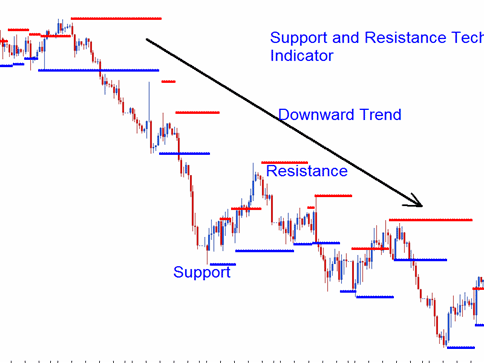

When analyzing a downward bitcoin trend, you'll want to identify the lower highs that illustrate this market movement. This setup should connect at least two highs, ensuring that the most recent one is indeed lower than its predecessor.

A down bitcoin trend occurs when the bitcoin crypto price forms and makes a series of lower highs and lower lows. Each bitcoin cryptocurrency price high is lower and lesser than the previous and prior bitcoin price high - lower high: LH, & each btcusd crypto price low is lower than the previous and prior btcusd crypto price low - lower low: LL therefore displaying bearish btcusd crypto price movement.

How Do I Analyze Downwards Trend?

How to Analyze Downwards Bitcoin Trend Line

The downward Bitcoin trend line highlights smaller support and resistance areas that collectively show a bearish directional bias for Bitcoin's movement.

How Do I Interpret Downwards Bitcoin Trendline

Access More Courses and Guides:

- Trade BTC USD Analyze Stop Loss BTC USD Order & Take Profit BTC USD Order

- MetaTrader 5 Bitcoin Trade iPhone App

- Best BTC/USD Indicators

- How Do I Analyze Trade Chart using Indicators?

- Upward Bitcoin Channel Indicator on MetaTrader 4 BTCUSD Charts

- What's a Good Stop Loss BTC USD Trade Order Setting Percentage?

- Ehler Fisher Transform BTCUSD Indicator

- What's the Best Way to Trade BTC USD When the Pattern Changes?

- What Happens in BTC USD after a Morning Star Candlesticks?

- Maximum Bitcoin Leverage vs Used BTCUSD Trade Leverage