What's a "hanging man" candlestick pattern in BTCUSD trading?

What Does Hanging Man Candle Mean? - Hanging Man Candle Definition

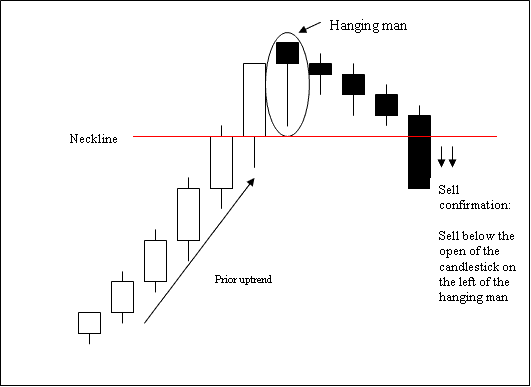

The Hanging Man candlestick pattern in cryptocurrency markets signals a bearish reversal during an upward trend. Its name derives from its visual resemblance to a man hanging from a noose.

A hanging man candlestick has:

- A small body

- The body is at the top

- Lower shadow is two or three times length of real body.

- Has no upper shadow or very small upper shadow if present.

- The color of the body isn't important

Understanding the Hanging Man Candlestick in Bitcoin Trading: Analysis of the Hanging Man Bitcoin Candle Pattern.

BTCUSD Candle Pattern

A sell signal for cryptocurrency is confirmed when a bearish candlestick closes below the opening price of the candlestick to the left of the hanging man pattern in the Bitcoin candlestick formation.

Stop orders should be placed a few pips just above the high of the hanging man candlestick.

Get More Courses & Tutorials:

- MetaTrader 4 Expert Advisor (EA) for BTCUSD

- Bitcoin: Analyzing Continuation Patterns

- Buy Stop Bitcoin Order & Sell Stop BTCUSD Order

- How to Open a Real MetaTrader 4 Account in MetaTrader 4 Trading Software

- Understanding Automated BTC USD Trading on MetaTrader 4

- Defining Market Maker Accounts for BTC/USD Trades

- How to Read and Interpret Downwards BTC USD Trendlines in Bitcoin Charts

- How can you draw trading channels on trade charts in MT5 Software?

- Analyzing Hammer Candlestick Patterns in BTC/USD Trading

- No Nonsense RSI Guide Tutorial