Tools and Techniques of BTCUSD Risk Management

Tools of Money Management in Bitcoin Trading

The best way to practice equity management in Bitcoin is for one to use Tools of Money Management in Bitcoin - Bitcoin Trade Funds Management Methods for Serious Traders and keep losses lower than the profits they make and earn in Bitcoin Trading. This is called risk : reward ratio.

Trading Tools of ==22==CryptoCryptoCurrency Capital Management

This btcusd equity management strategy is one of the Tools of Money Management in Bitcoin - Bitcoin Money Management Strategies for Serious Traders used to increase the profitability of a Bitcoin strategy by trading only when you as a trader have the potential to make more than Three times more what you're risking - Trading Tools and Techniques of Bitcoin Money Management - Tools of Bitcoin Money Management.

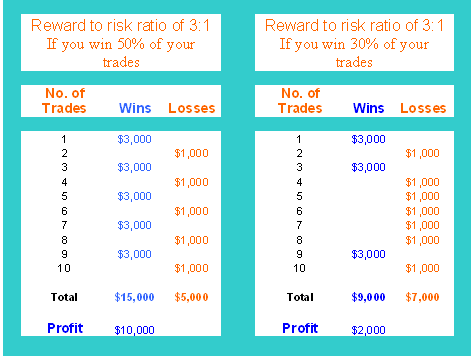

If you trade using a high risk reward ratio of 3:1 or more, you significantly/greatly increase your chances of becoming profitable in the longterm when BTCUSD Trading. TheBTC USD ==22==CryptoCryptoCurrency Chart below highlights you how: Rules of Money Management in Bitcoin - Bitcoin Money Management Strategies for Serious Traders

Bitcoin: A Bitcoin Trader's Money Management System Tutorial: Tools and Techniques of Bitcoin Money Management

In the first btcusd cryptocurrency examples, you can make the observation that even if you only won 50 % of your bitcoin trade positions in your Bitcoin account, you'd still make a profit of $10,000 - Tools of BTCUSD Money Management.

Even if your Bitcoin system win ratio went lower to about 30% you would still end up profitable - Trading Tools and ==22==TechniquesMethods of Bitcoin Money Management - What are Major Types of Bitcoin Risks?

What are Major Types of Bitcoin Risks? - Just remember that whenever you've got a good risk : reward ratio What are Major Types of Bitcoin Risks?, your chances of being profitable as a trader are greater even if you as a trader have a lower win percent for your Bitcoin system.

Never use a risk : reward ratio where you can lose more pips on one bitcoin trade than you plan to make. It doesn't make sense to risk $1,000 so as to make only $100 when trading the bitcoin market.

Because you have to win 10 times to make the $1,000 back. If you as a btcusd trader lose ONLY once in your Bitcoin then you as a trader have to give back all your Bitcoin profits.

This type of Bitcoin strategy makes no sense & you'll lose on the long-term if you use a Bitcoin strategy like this which's why you need Better Bitcoin Trading: Money & Risk Management Bitcoin Plan.

Trading Tools of Crypto Capital Management

The percent risk bitcoin trading equity management strategy is a method where you risk the same percentage of your bitcoin trading equity balance per bitcoin trade position - Tools of Money Management in Bitcoin - Bitcoin Money Management Methods for Beginner Traders.

Percent risk btcusd money management strategy specify that there'll be a certain % of your bitcoin crypto account equity balance that is at risk per each btcusd trade. To calculate the percent risk per each bitcoin trade, you need to know and learn about 2 things, percentage risk that you have chosen in your btcusd crypto money management plan & lot size of an open crypto order so as to calculate where to put the stop loss bitcoin order for your position. Since the % risk is known, one will use it to calculate the lot size of the bitcoin trading order to be opened in the bitcoin market, this is what is known as position size.

Tips for Transacting Tools of Bitcoin Money Management - What are Major Types of BTCUSD Risks?

Maximum Number of Open BTCUSD Trade Positions

Another point to consider is the max number of open cryptocurrency trade transactions that's the maximum number of trades that you as a trader want to be in at any one particular moment when trading bitcoin. This is another factor to decide and consider when developing money management rules and guidelines - Trading Tools and ==22==TechniquesMethods of Money Management.

If for example, you select & choose a 2 percent risk on your bitcoin trading plan, you may also select & choose to be in a maximum of 5 btcusd cryptocurrency trade positions at any one particular moment when trading the bitcoin crypto market. If all 5 of those btcusd trade transactions close-out at a loss in the same trading day, then as a trader you would have an 10 % decrease in your bitcoin equity balance that day.

Invest with Sufficient Bitcoin Capital - Tools of Bitcoin Money Management

One of the worst mistakes that traders & traders can make in bitcoin trading is attempting to open a account without sufficient equity.

The btcusd crypto trader with limited btcusd funds will be a worried investor, always looking to minimize btcusd trading losses beyond point of realistic btcusd cryptocurrency trading, but also will be often taken out of the trade positions before getting any success out of their bitcoin strategy.

- Exercise Discipline When Bitcoin Trade - Tools of Bitcoin Equity Management

Discipline is the most important thing that a trader can master to become profitable. Discipline is your ability to plan your bitcoin trade & stick to the equity management guidelines of your bitcoin trading plan.

A bitcoin trading plan will allow one to become disciplined & discipline will give you as the trader the ability to allow a bitcoin trade the time to develop without quickly taking yourself out of the btcusd market simply because you're uncomfortable with risk. Discipline also is your ability to continue to stick to your btcusd plan even after you have suffered losses. Do your best in btcusd bitcoin trading to cultivate and develop the level of discipline that's needed so that to be profitable.

Tools of Money Management in Bitcoin Trading

Bitcoin Funds Management, is foundation of any bitcoin system as bitcoin equity management helps the crypto traders to get and make profits when trading in the btcusd market. BTCUSD ==22==CryptoCryptoCurrency money management strategy is especially important when trading in leveraged btcusd cryptocurrency market, considered to probably be among some of the more liquid financial markets but at same time to be among one of the riskiest.

If you want to invest & trade successfully in online market you should realize that it's very important to have an effective bitcoin trading equity management strategy because you'll be using bitcoin trading leverage to place your crypto orders - Tools and Techniques of BTCUSD Money Management.

The variation between average bitcoin profits and btcusd trading losses should be strictly calculated, the bitcoin profit on average should be greater and higher than the bitcoin trading losses on average when trading bitcoin trading, otherwise bitcoin trading will not yield any profits. In this case a trader has to come up with their own bitcoin crypto account management guidelines, success of each trader depends on their individual traits. Hence, every trader makes his own btcusd strategy and develop their own bitcoin trading equity management guide-lines based on the above equity management strategy guidelines - Tools of Money Management in Bitcoin - BTCUSD Money Management Strategies for Beginner Traders.

When you're placing your orders in the bitcoin market put your crypto stop loss cryptocurrency orders in order and so as to avoid huge bitcoin trading losses. Bitcoin trading stop loss ==22==cryptocryptocurrency orders can also be used to lock in bitcoin btcusd trading profit while trading the bitcoin market.

Consider the chance of getting profit against chance to get bitcoin trading loss as 3:1 - this risk:reward ratio should be favorable more on profit side - Tools of Bitcoin Money Management - What are Major Types of Bitcoin Risks?

Considering these bitcoin equity management guide-lines & guide-lines - & as bitcoin trader you can use these guidelines to help improve profitability of your bitcoin strategy and try to come up with your own bitcoin strategy & bitcoin system that will possibly give you good profits when trading with your Bitcoin Trade Funds Management Plan.

More Tutorials & Topics:

- How Can You Calculate BTCUSD Lot Size for Mini BTC/USD Account in MT4 Software Platform?

- How Can You Draw Fibonacci Extension Levels in Downwards BTC USD Trend?

- MACD ==22==BTC/USDBTCUSD Technical Indicator Analysis MACD ==22==BTC/USDBTCUSD Technical Indicator

- How to Trade MetaTrader 4 BTCUSD Trendlines Trading Indicator & ==22==MetaTrader--4 Bitcoin Channels Indicator in MT4 Software Platform

- Bitcoin MT4 Opening a ==22==MetaTrader--4 BTCUSD Trading Chart Lesson Guide

- What Happens in Bitcoin Trading after a Bitcoin Pattern Breakout?

- How Can You Set Bulls Power BTC/USD ==22==Technical Indicator in Chart in MT4 Software Platform?

- MT5 BTC/USD iPhone Trading App

- How ==22==CanDo You Analyze/Interpret MetaTrader 4 Fibonacci Pullback in MT4 Software Platform?

- Bitcoin Charts Trading Analysis in Bitcoin Trading Definition