Spot Bullish and Bearish Stochastic Divergence on Bitcoin - Bitcoin Trading Signals

Divergence bitcoin trading represents one of the bitcoin trading signals that can be found and made when utilizing the stochastic oscillator bitcoin indicator.

Divergence bitcoin trading is a signal that a rally or retracement is losing steam and is likely to reverse. It means that last buyers or last sellers are pushing bitcoin price in one way while majority of other btcusd traders have stopped trading in that direction & are cautious of a btcusd price correction or pull back.

4 types of divergence trade setups explained

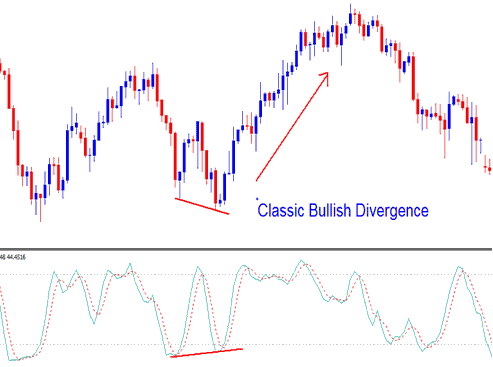

Example 1: Classic Bullish Divergence Trading Setup

A bullish divergence detected in the stochastic indicator for Bitcoin Classic, coinciding with the Bitcoin price action, is typically followed by an upward trajectory in Bitcoin's value.

Stochastic Oscillator: A classic bitcoin indicator for bullish divergence in bitcoin.

If Bitcoin keeps hitting new lows, but the Stochastic indicator isn't dropping lower too, that's a big clue. It signals that the downtrend could be running out of steam and a bullish rally might be just around the corner.

An example highlighted where Bitcoin's price reached a new low, which was not reflected by a corresponding low in the Stochastic Oscillator. This type of divergence occurs when the Stochastic indicator does not align with price movement, potentially signaling a viable trading setup based on classic divergence analysis.

Since it combines a divergence bitcoin trade setup with a subsequent move above the 20% trading indicator level, the Bitcoin classic divergence trading configuration pattern is even more powerful. This trade divergence trade setup combines the Overbought and Oversold levels.

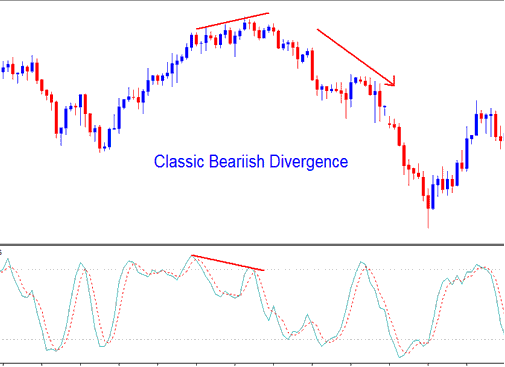

Example 2: Classic Bitcoin Bearish Divergence

A classic Bitcoin bearish divergence setup happens when the stochastic oscillator signals it, and the Bitcoin price drops right after.

Stochastic Indicator Classic Bearish Divergence Trade Setup

When the price of bitcoin reaches new high values, but the Stochastic oscillator indicator does not go higher than its previous high, it suggests the bitcoin trend will reverse, and a bitcoin bearish divergence trade will likely happen.

This standard bearish divergence setup in Bitcoin trading gains more power from the mix of divergence and a drop under the overbought line at 80.

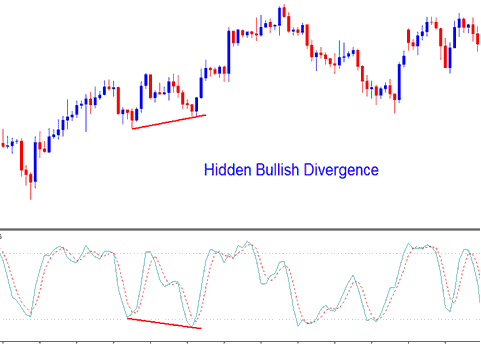

Example 3: Hidden Bullish Divergence

A hidden bullish divergence in Bitcoin signals a pullback in an uptrend. This setup is the best divergence to trade. It lets you trade with the Bitcoin trend, not against it by betting on a reversal.

Stochastic Indicator Hidden Crypto Bullish Divergence

Despite the stochastic oscillator indicator registering a lower trough, the actual low point achieved by the Bitcoin price was demonstrably higher than the preceding low (resulting in a higher low: HL designation). This signifies that although cryptocurrency sellers made a determined effort to suppress the Bitcoin valuation, as indicated by the stochastic movement, this downward pressure was not mirrored in the realized Bitcoin price, which failed to establish a new absolute low. This specific scenario represents the superior juncture to initiate a purchase order for Bitcoin, particularly since the market is already situated within an upward trajectory, thus negating the need for a passive wait for a confirmatory Bitcoin trading signal before executing a buy within a prevailing upward Crypto trend.

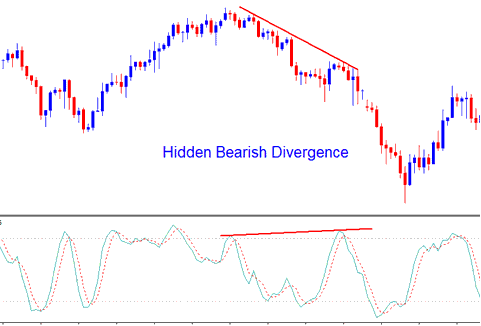

Example 4: Hidden Bitcoin Bearish Divergence

A trading scenario known as Hidden Bearish Divergence suggests an impending pullback within an otherwise declining price trend.

Stochastic Indicator Hidden Crypto Bearish Divergence

Hidden bitcoin trading bearish divergence setup is the best type of divergence to trade, because you're not trading a bitcoin price trend reversal, but you're trading within the direction of the trend. This is the best place to open/execute a sell bitcoin trade, since it is even in a downward bitcoin trend there's no need for you to chill and wait for a confirmation bitcoin trading signal, because you are selling in a downward Bitcoin trend.

Learn More Courses & Tutorials:

- Market Behavior in Bitcoin Following the Appearance of a Double Bottom Pattern

- Learn BTCUSD Crypto Trading Indicators

- Guide to Opening a Live Trading Account on the MetaTrader 4 Software

- How to Learn BTC/USD Trading Beginner Learn Training Courses

- Executing Fibonacci Extension Drawings for Bitcoin on MT4 Charts (BTCUSD)

- How Can You Trade Use Learn MT5 Mobile Trading Android App Course Tutorial?

- A beginner's guide to trading BTC/USD.

- Adding and Managing Trade Orders on Your Platform

- How Can You Analyze/Interpret a BTCUSD Course Tutorial?