Short-Term & Long-Term Bitcoin Price Moving Average Periods

A trader can pick to regulate the bitcoin rate durations used in calculating the shifting average.

If a trader employs short bitcoin price intervals, the Moving Average will respond more swiftly to fluctuations in bitcoin prices.

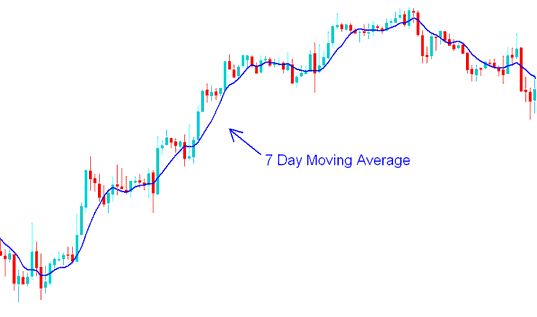

For instance, if a speculator utilizes the 7-day moving average for Bitcoin analysis, this indicator will react to variations in Bitcoin's price considerably more swiftly compared to a 14-day or 21-day Moving Average calculation. Conversely, employing short-term intervals for the MA derivation risks the indicator generating erroneous BTCUSD signals (frequently referred to as whipsaws).

7 Day Moving Average(MA) - Moving Average Bitcoin Methods

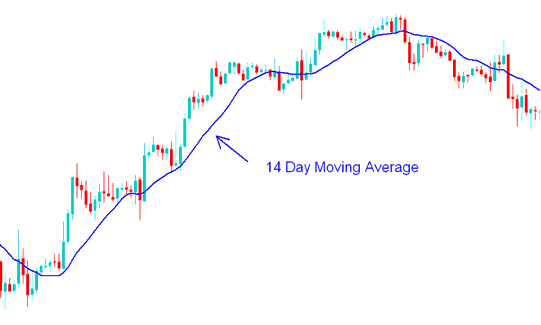

If another trader uses longer chart periods, then the Moving Average will react to bitcoin price changes much slower.

For instance, if a trader implements a 14-period Moving Average, this average will exhibit less susceptibility to rapid fluctuations (whipsaws) but will respond to price changes more sluggishly.

14-Day Moving Average - An Illustrative Example of a Bitcoin Trading Strategy that Leverages Moving Averages.

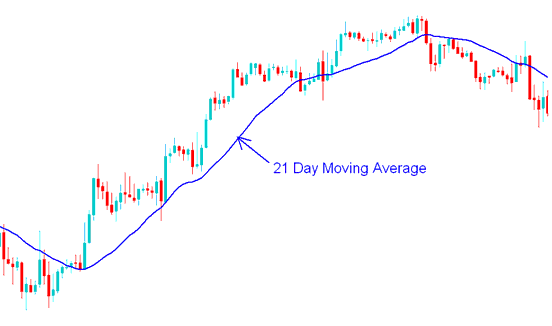

21 Day Moving Average - Moving Average Bitcoin Strategies Example

Study More Lessons and Tutorials & Topics:

- Setting On Balance Volume Indicator for BTCUSD on MT4 Charts

- Utilizing Fibonacci Pullback Levels Within the MT5 Application

- A Tutorial on How to Show BTC USD Instruments in MT4.

- When to Exit BTC USD Trades & Setting BTC USD Stop Losses

- Chandes QStick BTC/USD Indicator Trading Analysis in BTCUSD Crypto Currency Trading

- Different Bitcoin Trading Accounts: What You Need to Know