Ehler MESA Adaptive MA Bitcoin Analysis: Technical Insights and MESA Trade Strategies

Mesa Adaptive MAs was created by John Ehlers

Originally used to trade commodities & stocks.

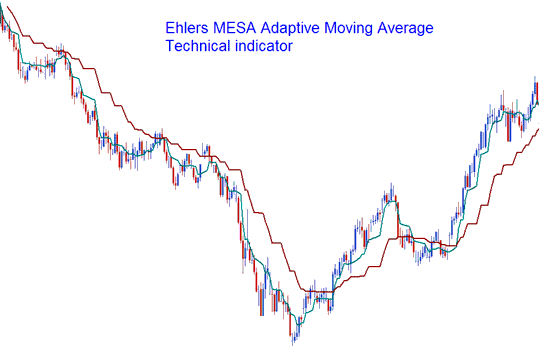

MESA Adaptive average looks like 2 MAs. But the MESA moves like stairs and not in a curved line like the Moving Average. The example here shows this tool on a chart of bitcoin prices.

Ehler MESA Adaptive Moving Average

The MESA Adaptive Moving Average is a bitcoin trend following indicator which adapts to bitcoin price action movement based on the rate of change of bitcoin price as measured by the Hilbert Transform Discriminator. This btcusd indicator will generate a signal when the two MAs cross one another. Trade Positions should be executed in the direction of the MESA averages.

This method features a fast Moving Average and a slow Moving Average so that as composite average quickly follows behind the bitcoin price changes and holds the average value until the next candlestick close occurs. This btcusd indicator is less prone to whip-saws compared and analyzed with original Moving averages. This is due to the formula used to calculate the rate of change relative to the bitcoin price movement.

Learn More Courses & Tutorials:

- Types of Reversal Candlestick Patterns Observed in BTCUSD Trading

- Kinds of BTCUSD Price Move Bitcoin Price Move Plan Lesson Guide

- Platforms for Bitcoin Trading on PC

- Trading Tutorials and Course Guide

- Using Take Profit and Stop Loss Orders in Trading Software

- Best BTC/USD Broker for BTC USD New Investor Trading

- Best Tools for MetaTrader 4 BTCUSD Trading