Characteristics of the three major trading sessions: Asia, Europe, and USA

Asian Session

During the Asia market only 8 % of total daily transactions go through Tokyo desks. This is the least active of the 3 major sessions. Most of this 8% only involves yen based trading with very little transactions happening for other instruments. Because of this reason it's not suitable to trade the market during this period. Not during this market trading period will save you as a trader lots of time & money.

European Session

The London/European market dominates the total transactions, with 34% of all transactions occurring during this session. The London time zone is strategically positioned for business hours that benefit both eastern and western economies, leading to market overlaps that result in a high volume of trade transactions during this period. This timeframe represents the most liquid and volatile market session for all cryptocurrency instruments.

The European timezone encompasses the member countries of the EU zone. The Eurozone consists of 17 members, and the major banks within these nations are operational, resulting in significant liquidity due to the high volume of transactions being conducted.

US Market Session

The US market accounts for 20% of the total global trading volume. The most active period for market engagement occurs roughly between 8 a.m. and 12 p.m., coinciding with the overlap when both the London and New York dealing centers are operational. This timeframe typically exhibits the highest volatility and often aligns with the release of major US economic data.

European USA Market Session Over-lap

These are hours characterized by a higher volume of trade transactions, thus enhancing the chances of making a profit.

For day traders, the London-US session overlap brings peak activity. High volume hits then, making the BTCUSD market lively.

During this overlapping period, a significant quantity of economic news data is released, leading to substantial price volatility and rapid bitcoin price movements. This creates numerous openings for executing trades, positioning this overlap as the premier trading opportunity for those aiming to maximize returns.

The best hours for trading, are during this over lap because the bitcoin prices really move and the moves are decisive and offer the best chance to make profits

This is also the reason why traders in Asia, such as in Japan, often wait until the afternoon to begin and place their orders, because this time lines up with when markets in Europe and the US are open.

Asian traders skip Bitcoin deals in their hours. As a global player, wait too for better flow. Trade in US-UK overlaps instead. Liquidity runs high there.

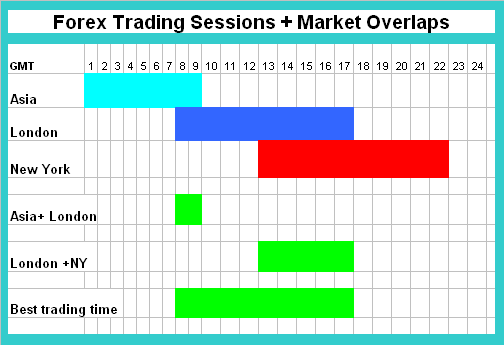

Therefore to develop the best hours using based on these 3 sessions like as shown:

Market Hours & Overlaps

The chart above shows the times when each trading session begins and ends. The chart also shows overlaps and the best trading hours.

Summary:

Determine Your Schedule

Your schedule depends on the kind of trader you are. A longer-term approach would be ideal for you if you don't have a lot of time. If, on the other hand, you have plenty of time, you may choose to establish an intra-day trading schedule where you initiate btcusd trades during the busiest periods of market activity. According to the aforementioned graph, the optimum GMT hours to be in the btcusd market are between 800 and 1800 GMT.

Determine your timeframe

To establish a schedule, you must determine your chart time-frame. Experiment with various chart time-frames until you identify the one that is most suitable and comfortable for your schedule.

Test your bitcoin strategy

Test your bitcoin strategy on a demo account for a while. Record each trade and check your progress. Note the best times for profits.

Your strategy should be specified on the trading plan which you use.

To learn and know more about how you can specify this in your trade plan, read the lesson about Bitcoin plan. This learn bitcoin tutorial will show you an example illustration of a format that you can use to specify your schedule.

Study More Lessons:

- Bitcoin MT4 Opening a MetaTrader 4 BTCUSD Trading Chart Lesson Guide

- Beginner's Guide to the MetaTrader 5 BTC/USD Platform

- Placing a BTC/USD Buy Stop Order on the MT4 Platform

- Calculation Guide for Determining Nano Lot Size Requirements for BTC USD Trades on a Nano BTCUSD Account

- Strategies for Capitalizing on Bitcoin Reversal Patterns in Trading