Setting A Bitcoin Schedule and a Written Examples

Bitcoin operates on a global scale, which means the BTC/USD market is available for trading 24/7. This global accessibility grants traders considerable flexibility in selecting trading times, although not all moments are equally suitable for transactions.

Investors should establish a trading schedule aligned with the most active Bitcoin hours to maximize profitability.

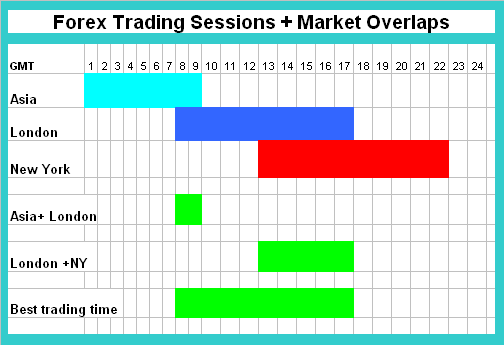

USA & London sessions are the most active times. These 3 market sessions make up the biggest volumes of trade transactions from across the world/globe on a daily basis, although Asian is one of these three market sessions its best not to trade or transact during this particular market session.

There are also times when the 3 sessions overlap, meaning 2 sessions are open at the same time, and these overlaps are the busiest trading times. These overlaps provide a great chance to be involved in many markets at once and increase the chance of making more profit.

The greatest overlap occurs during the time when the US and London markets are both open. It's during this period that the btcusd market is most lively, with more chances to trade.

The Asia session is the least busy of the three main sessions. All trading tools move slowly or stay in one place during this market session. It's not a good time to be trading btcusd: it's better to take a break then.

Trading runs day and night. No one can stay awake that long. Set a solid schedule instead. Know the hours to pick the best times. This boosts chances for bigger profits.

Your Trading Schedule Should Meet These Goals:

1. Get to know each of the different trading times. These include the New York session, the London session, and the Tokyo session.

London Session - 3 A.M. - 12 P.M. EST ( 8:00 GMT to 1700 GMT. )

New York Market Session - 8 A.M. - 5 P.M. EST (1300 GMT to 2200 GMT.)

Trading Hours for the Tokyo Market Session: 7 P.M. to 4 A.M. Eastern Standard Time (Corresponding to 00:00 to 9:00 GMT.)

2. Trade during this time when bitcoin prices are most active.

3. Make a schedule that works, so you can balance your trading time with enough time to rest: the best time is between 3 a.m. and 5 p.m. EST.

With US and UK sessions open, bitcoin prices tend to push up or down by many pips. As an analyst, indicators deliver solid trend-catching signals then.

Profits become more accessible for traders when bitcoin's valuation exhibits rapid upswings and declines.

In Asian hours, bitcoin prices stay in ranges. Indicator users struggle for gains due to false signals. Range moves make bitcoin trading tough for profits.

Making money in bitcoin is 10 times easier in up or down moves. It gets tough in flat ranges.

The best times to make trades are at 800 GMT and 1800 GMT, when bitcoin prices usually move in one way, but at other times, like during the Asian Session, bitcoin prices tend to move up and down.

- London session 08:00 GMT -16:00 GMT.

- US market session 13:00 GMT - 22:00 GMT.

- Asian market session is a relatively slow for all instruments and not suitable at all.

Essentially, your trading strategy should focus on 800 GMT and 1800 GMT as key trading times.

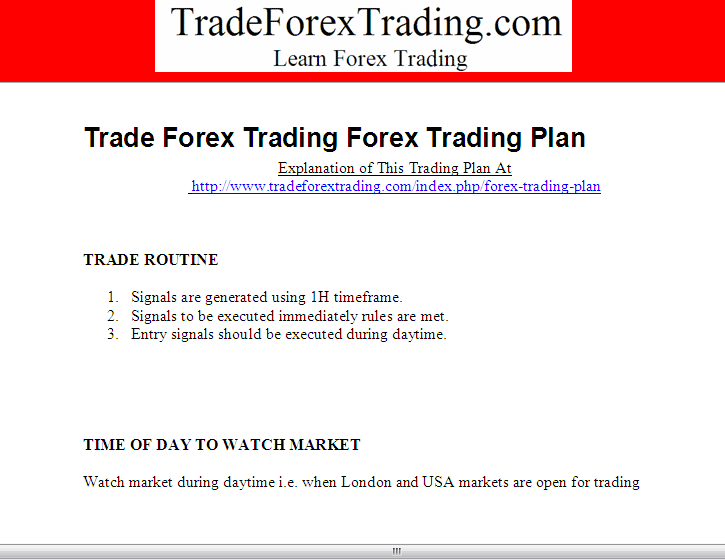

Explanation of a Schedule on a Bitcoin Plan

The example below shows you how to set up your routine and the time of day to watch the btcusd market. This will be the base for your schedule. The timeframe you use will also be set, and it mostly depends on what type of trader you are. The time in this example is during the day when the UK and US markets are open, as you can see in the cryptocurrency example below.

Written Bitcoin Schedule - Bitcoin Plan Sections

More Subjects and Online Classes: