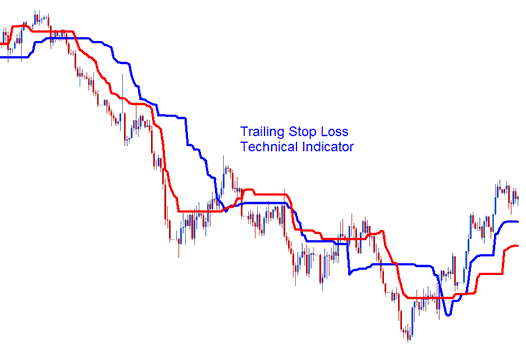

Trailing StopLoss Levels Analysis Signals

Created by Tushar Chande.

This is a volatility based indicator that is used to estimate levels to set stoploss levels. Distance at which it estimates trailing stop level is determined based on the market volatility.

The Levels of the 2 lines, these two lines represent:

- Long Stop Level - Blue Line

- Short Stop Level - Red Line

Long stop level line has a much wider range in terms of where it trails stop loss as compared to the short stop level that implements a tight stop loss.

This indicator is volatility based when it comes to trailing and following the price action. Trailing Stop Levels will trail the above the price in a downward market trend and trails below the price in an upward trend.

Forex Analysis & Generating Signals

These will be calculated using volatility to calculate where to plot the indicator - this is used to determine what levels to set stop losses.

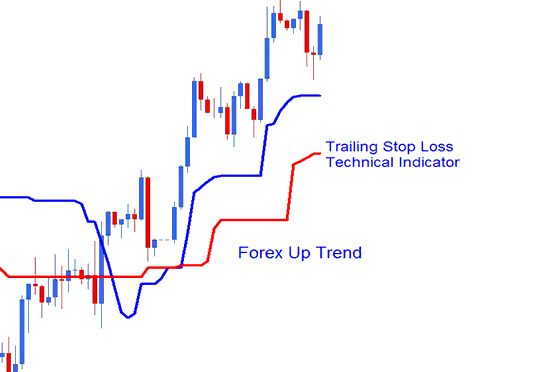

Upward Trend

In an upwards trend these levels will follow below the currency price. The trader can use either the short stop level line to set up a tight stop or the long stop level to set a stop loss that isn't very tight. As the price goes higher the trailing level also goes higher. An exit signal gets generated when the price crosses below these levels.

Uptrend

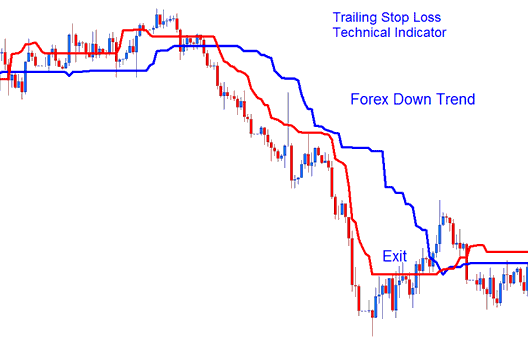

Downward Trend

In a downward trend the stop loss levels will trail above the currency price this two levels can be used to set these levels. As the price drops further these levels will continue to drop lower and follow the price lower. An exit signal gets generated when price crosses above these levels.

Downtrend

When price starts to retrace these levels won't retrace but will remain at their levels, this will mean at some point the trade will be closed by the trailing stop loss.