Bollinger Band - Fibonacci Ratios Analysis & Signals

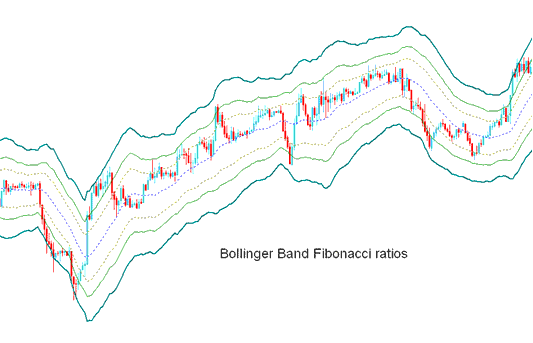

Derived from the original and initial Bollinger band.

The Bollinger Fib ratios is a volatility based indicators but it doesn't use the standard deviation method to calculate width of the channels instead it uses a smoothed ATR that is multiplied with Fibonacci ratios of 1.618, 2.618, & 4.236.

The smoothed lines which are multiplied with Fib ratios are then added or subtracted from the Moving Average MA.

This forms Three upper Fibonacci bands and Three lower Fibonacci bands

Middle band forms the basis of price trend.

Technical Analysis and Generating Signals

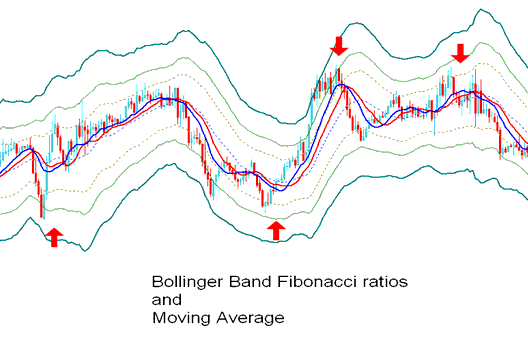

This indicator used to determine point of support & resistance for a currency pair.

Lines below represent support levels while those above are resistance levels.

The outer-most bands provide the strongest resistance/support.

The inner most bands provide least support/resistance.

The innermost band represents Fibonacci 38.2 % retracement level

The second band represents Fibonacci 50 % retracement level

The outermost band represents Fibo 61.80 % retracement level

The Indicator is used to figure out points where price may & might reverse. (Price Pull-back Levels)

When price hits one of the lines & reverses then an entry or exit trading signal gets generated.

However, it is always good to combine the signal with other confirmation indicators like the Moving Average(MA) to confirm the signal just as shown below.

Technical Analysis in Forex Trading

Study More Tutorials and Guides & Lessons:

- Insert Cycle Lines, XAUUSD Chart Text Label in XAUUSD Charts on MT4 Platform Software

- How to Calculate Number of Pips in Trading Forex Pairs Moves

- How Can I Use MetaTrader 5 Parabolic SAR on MT5 Software?

- USDZAR System USDZAR Trading Strategy

- How Can I Calculate Value of 100 Forex Pips When Mini Lots?

- True Strength Index (TSI) MetaTrader 4 Indicator

- FX Trade Leverage and Margin for Mini Account Explained

- How to Master Forex Course Tutorial Courses Key Concepts