Multiple Time Frame Bitcoin Strategy

Multiple time frame bitcoin analysis equals using 2 timeframes to trade bitcoin - a shorter time frame used for trading & a longer time frame used to check the cryptocurrency trend.

Since it is always good to follow the bitcoin trend when btcusd trading, in Multiple Time-frame Bitcoin Analysis, the longer time frame provides us the direction of the long term cryptocurrency trend.

If the long-term bitcoin trend direction supports the market direction of the smaller time frame then probability of opening a profitable bitcoin trade is significantly increased. This is because even if you make a mistake the long-term btcusd crypto trend eventually will save you. Also if you trade within the direction of the btcusd trend, then mostly you'll be on the winning side - this is what this Multiple Time-frame Crypto Analysis is all about.

Remember there's a popular saying by many btcusd cryptocurrency traders that says: "The btcusd trend is your best friend' - never go against the btcusd crypto trend when trading.

There are 4 different types of bitcoin traders - all these different types of bitcoin traders use different chart time frames to trade just as displayed & shown below.

Examples of how each type of Bitcoin trader uses multiple TimeFrames Bitcoin analysis strategy:

BTC USD ==22==CryptoCryptoCurrency Scalpers

Scalper Traders hold on to their trade positions for only a couple of minutes. Scalper btcusd crypto trader never holds onto a btcusd crypto trading for more than Ten minutes. With main objective of earning a small number of pips as trading profit, 5 pips to 15 pips.

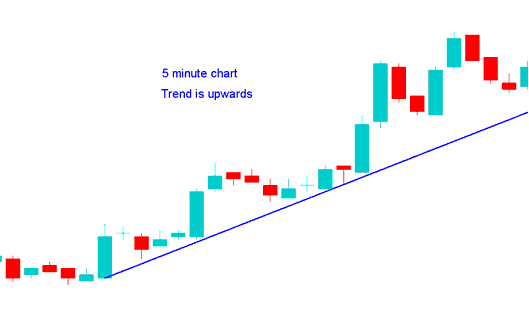

A Scalper using 1 min crypto chart time frame wants to open long, checks 5 minute chart, which looks like the one below, since 5 min cryptocurrency chart show btcusd trend is heading upwards, then decides from this crypto analysis it's ok to open a buy bitcoin trade.

Multiple Time Frame Crypto Trading

Bitcoin Day Traders

Day bitcoin traders hold onto their open cryptocurrency trade transactions for few hours but not more than a day. With main objective of earning quite a number of pips profit: 30 - 60 pips.

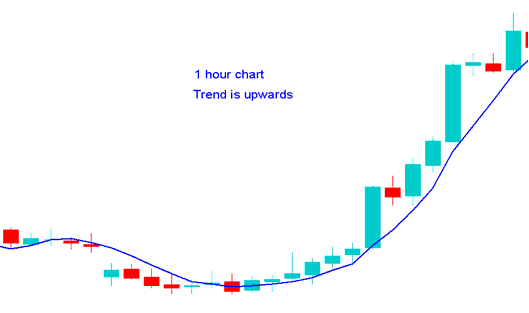

BTCUSD day trader 15 min crypto chart timeframe wants to open long, checks H1 chart, which looks like the cryptocurrency chart below, since H1 chart shows bitcoin trend is heading upwards, then decides from this cryptocurrency analysis it's ok to open a buy btcusd cryptocurrency trade.

Multiple Time-frame Analysis Intraday Trading - Multiple Time-frame Trading Methodology Lesson

Swing Traders

Swing btcusd traders hold onto their open cryptocurrency trades for few days to a week. With the objective of earning a large number of pips profit: 100 - 250 pips.

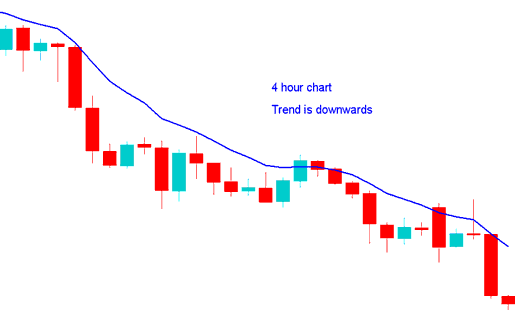

Swing trader using 1 Hour chart timeframe wants to go short, checks 4 H chart, which looks like the crypto chart example shown below, since H4 chart shows the bitcoin trend is heading downwards, then decides from this cryptocurrency analysis it's ok to open a sell btcusd crypto trade.

Multiple Time Frame Trading - Multiple Time-frame Trading Crypto

Position BTC USD Crypto Traders

Position btcusd traders are the BTCUSD traders that hold onto their trade transactions for weeks or months. With the objective of earning a large number of pips profit: 300 - 800 pips.

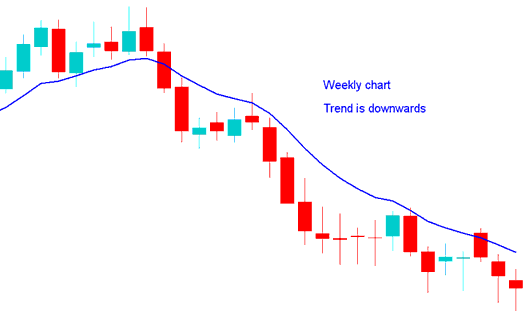

Position btcusd trader using the daily cryptocurrency chart timeframe wants to go short, checks week chart, weekly resembles the crypto chart example shown below, since weekly crypto chart shows the bitcoin trend is heading downwards, then decides from this cryptocurrency analysis it's ok to open a sell btcusd crypto trade.

Multiple Time-frame Strategy Course

How to Define A BTCUSD Trend

Using a cryptocurrency trading system which has Three cryptocurrency indicators - MAs Cross Over Strategy, RSI & MACD Indicator - ==22==& uses simple guidelines to define the cryptocurrency trend. The Trading Rules Are:

Upwards Bitcoin Crypto Currency Trend

Both MAs Moving Up

RSI Bitcoin Indicator Above 50

MACD Bitcoin Indicator Above Center Line

Down-ward Bitcoin Trend

Both MAs Moving Averages Moving Down

RSI BTCUSD Indicator Below 50

MACD Bitcoin Indicator Below Centerline

More Topics & Tutorials:

- How ==22==CanDo You Analyze/Interpret BTC USD on MT4 Software Platform?

- When is BTC/USD Market Least Active?

- Find to Know Your How Can You Use BTCUSD Trading MT4 Platform to Trade BTCUSD?

- How to Trade Bitcoin Channel Breakout Strategies

- Bitcoin Place a Sell Limit BTC USD Order in MT5 Platform

- How Can You Trade Candle?