Divergence Explained

RSI is one of the often used divergence trading indicator. This bitcoin crypto indicator is an oscillator similar to the RSI and it can be used to trade divergence trade setups just the same way as RSI indicator.

RSI Bitcoin Analysis & RSI Signals

RSI Divergence Indicator

RSI Divergence Trading Indicator

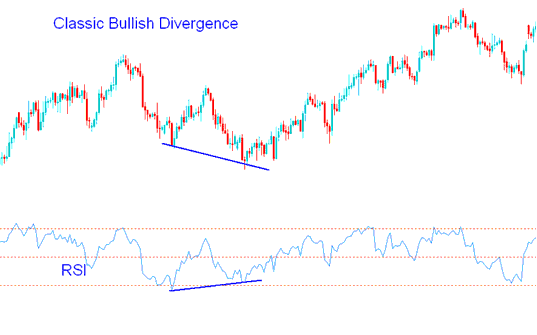

Classic RSI Bullish BTC/USD Divergence Trading Setup

RSI classic bullish divergence setup occurs when bitcoin price is making lower lows (LL), but the RSI is making/forming higher lows ( HL ).

Bitcoin Classic Bullish Divergence - RSI Divergence Explained

RSI classic bullish divergence setup warns of a possible change in the bitcoin trend from downward to upwards. This is because though the bitcoin market price went lower the volume of the sellers who pushed bitcoin price lower was less such as illustrated & shown by the RSI ==22==technical indicator. This is an technical indicator of the under-lying weakness of the downwards trend.

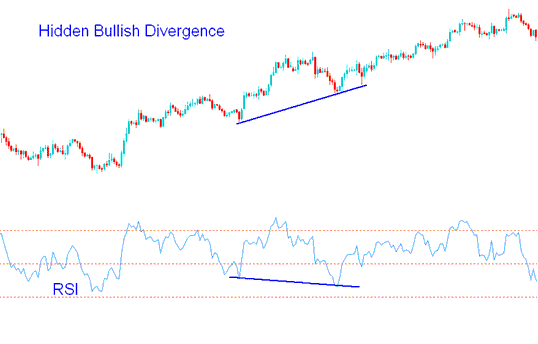

Hidden RSI Bullish BTC/USD Divergence Trade Setup

Forms when bitcoin price is forming/making a higher low (HL), but the RSI is showing a lower low ( LL ).

RSI hidden bullish divergence setup forms when there's a price retracement in an upwards cryptocurrency trend.

Crypto Hidden Bullish Divergence - RSI Divergence Explained

This setup confirms that a retracement move is complete. This RSI divergence trade setup shows under-lying strength of an upwards cryptocurrency trend.

RSI Divergence Indicator

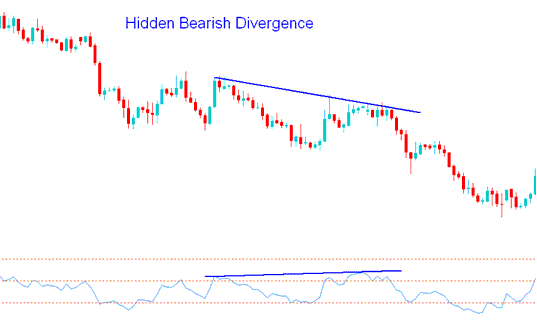

Hidden RSI Bearish BTC/USD Divergence Trading Setup

Forms when bitcoin price is forming/making a lower high (LH), but oscillator technical indicator is showing a higher high ( HH ).

Hidden bearish divergence forms when there's a retracement in a downward cryptocurrency trend.

Crypto Hidden Bearish Divergence - RSI Divergence Explained

This setup confirms that a retracement move is complete. This divergence reflects strength of a downward cryptocurrency trend.

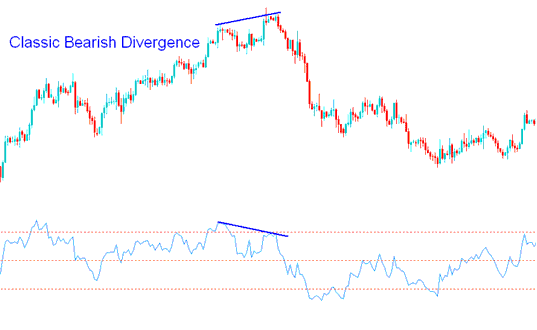

RSI Classic bearish BTCUSD ==22==CryptoCryptoCurrency Divergence Trading Setup

RSI classic bearish divergence setup occurs when bitcoin price is making a higher high (HH), but the RSI is forming a lower high ( LH ).

Crypto Classic Bearish Divergence - RSI Divergence Explained

RSI Classic bearish divergence pattern warns of a possible change in the bitcoin trend from upward to downwards. This is because though the bitcoin market price went higher the volume of the buyers who pushed bitcoin price higher was less just as is illustrated & shown by the RSI ==22==technical indicator. This is an technical indicator of the under-lying weakness of the upwards trend.

Learn More Tutorials & Courses:

- Darvas Box BTCUSD Technical Indicator Analysis in Trading Charts

- How to Read and Interpret Falling Wedge Pattern Explanation

- How Can You Learn How to Use Demo BTCUSD Account?

- How to Practice Bitcoin Trading with BTCUSD ==22==PracticeDemoPractice--Demo Account Demo Account

- How Can You Make a MetaTrader 4 Trade Account to Trade?

- BTC USD ==22==TrendlineTrend--lineTrend-line Explained

- How to Trade Different Types of Bitcoin Candles Patterns

- Bitcoin Trading Best Trade Online Tutorial

- How to Open BTCUSD Trade

- What is Market Maker BTC USD Trade Account Meaning?